Exit Strategy - Summary and review

🚀 Summary: Exit Strategy in 30 seconds

Contents

Contents

When is it the right time to sell?

Navigating the process & players involved in an exit

Beyond the big check

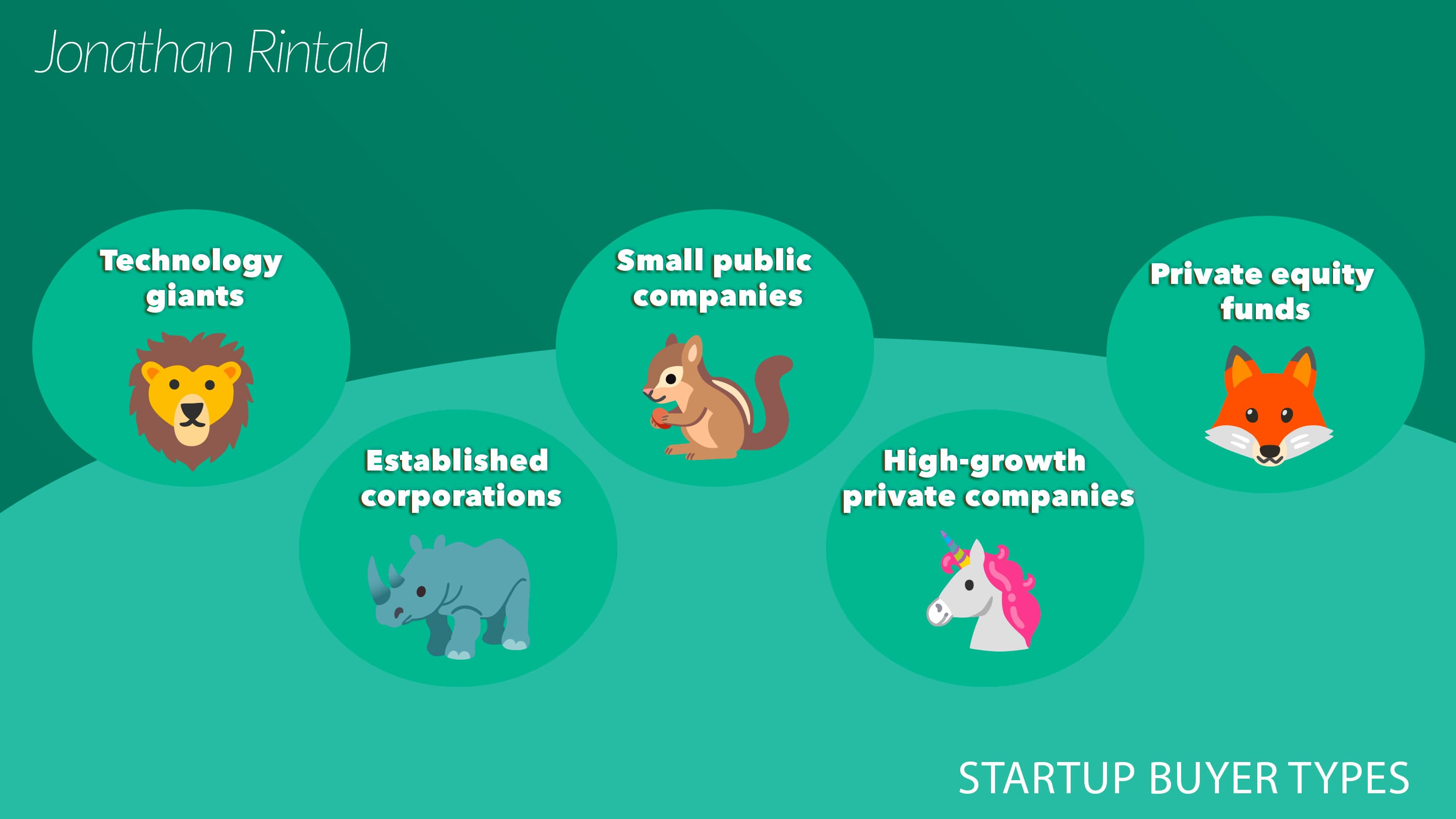

Who buys startups? 5 types of buyers

Buyers of startups and SaaS companies are generally divided into 5 categories - each with slightly different rationale for buying, things they will look for in your business, and money they are willing to pay.

See the following 5 types of buyers - from the buyer that will pay you the most to the least.

1. Strategic buyers

A strategic buyer is usually a company in your space that wants to acquire your business for a specific reason. This means your SaaS is often more valuable to them (it's more unique) and they might have a higher FOMO that another buyer might sweep you up instead.

Thus, strategics tend to pay the highest price for your SaaS.

I like the Magic Box Paradigm categorization of startup buyers as well - where it's about:

Technology giants

Established corporations

Small public companies

High-growth private companies

(Private equity funds)

Stake

Strategic buyers often want to acquire 100% of your SaaS. In some more rare cases they might start as a minority partner and later on buy the full company.

Goal with acquisition

These buyers have strategic goals with the acquisition. It could be:

Your team (acqui-hire)

Your tech or IP (propertary technology, integrations, etc)

Your customers (enterprise segment, geographical traction, new ARR)

Removing your SaaS from the competitive market

Synergies (use the same CS team, cloud, etc)

2. Private Equity (PE)

Private Equity is it's own category of buyer as well. These are private funds that aim to buy already proven companies with growth potential left - for example by slicing staff, or bringing on experienced management.

Stake

PE often want to acquire majority stake, or a substantial minority stake > 40% - as well as board seats to be able to influence the growth.

ARR range: > $1M ARR

Usually PE gets interested beyond > $1M ARR. Worth noting is that PE funds might do follow-on acquisitions in existing portfolio companies that might find strategic value in your SaaS.

Sweet spot: $2 - 20M ARR (80% av all acquired companies in this range sell to PE funds)

Goal with acquisition

PE funds are financial buyers meaning they will evalute your finances (first) - and selling them on a vision might be more difficult than a strategic buyers that might see future growth potential or other soft values.

3. Search Funds

A search fund is a recent MBA graduate that raises private capital to buy your SaaS and operate it. Either self-funded or backed by other investors.

Often search funds target companies <$2M - ie. that are too small for private equity. Also, often targeting companies like service businesses and manufacturing - ie. outside the SaaS space.

4. Cofounders

Just because you founded the company together doesn't mean you will exit together.

A quite common scenario is that your co-founder will for some reasons sell some or all of their shares in the business. Maybe you have different growth goals, life situations, or drive - and one co-founder wants to move on.

5. Your Network, Customers, or Employees

Also, sometimes your customers or employees even might become buyers of your business. It's common in more traditional brick-and-mortar companies.

For a SaaS it might be a large enterprise customer that simply find your company too valuable for them and decide to buy your company to mitigate risks, or even expand their own offering.

Buy the book: Exit Strategy 👇

If curious in more, you can buy the full book on Amazon: Print | KindleExit Strategy review - what kind of book is it?

A really solid read on startup exits - the before, during, and after. Focused on the psychological aspects of the founder - so a nice complement to other reads like Built To Sell or Magic Box Paradigm. At times a bit "too fluffy" and focused on soft aspects. But a warm recommendation for all entrepreneurs that looking to exit their business at some point.

Frequently asked questions (FAQs)

Q: Who is Rob Walling, Sherry Walling?

Rob is a serial startup founder with notable exit of SaaS platform Drip, investor in >170 startups, and author of 4 books on startups. Rob started TinySeed - the first accelerator for SaaS bootstrappers, as well as the SaaS bootstrapping community MicroConf. Dr. Sherry is an author, podcaster, and practicing psychologist who specializes on the mental aspects of entrepreneurship.

Q: Why should you read Exit Strategy?

Get ahead of the curve and understand the psychological aspects of what it takes to make a successful exit.

Q: Who is the ideal reader of Exit Strategy?

Any startup founder in the journey of building their venture - whether thinking of the idea of exiting or just hammering growth for a big exit down the line. Whether it's your first startup or you are a seasoned serial entrepreneur.

Want to learn more about growing SaaS companies?