Magic Box Paradigm: A Framework for Startup Acquisitions - Summary and review

🚀 Summary: Magic Box Paradigm: A Framework for Startup Acquisitions in 30 seconds

Contents

Startup acquisition terminology

Here are some key terms the book introduces - and you should know in order to sell your company.

Term | Definition | Explanation |

|---|---|---|

M&A | Merger and Acquisition | An umbrella term for merging, buying, or selling companies. |

PSP | Potential Strategic Partner | The potential buyer of your company |

PBI | Partner Big Idea | The big plan and idea of all the synergies the buyer will get - even if you have not talked in terms of M&A yet. This could be benefits from partnerships - lowered CAC, less churn, more data, etc. Often presented as a 30-40 page slide - ideally that you build together with the PSP over time. |

MLP | Market Leadership Positioning | A short, sweet and compelling picture of what supremacy looks like in your market. This is the vision you sell. |

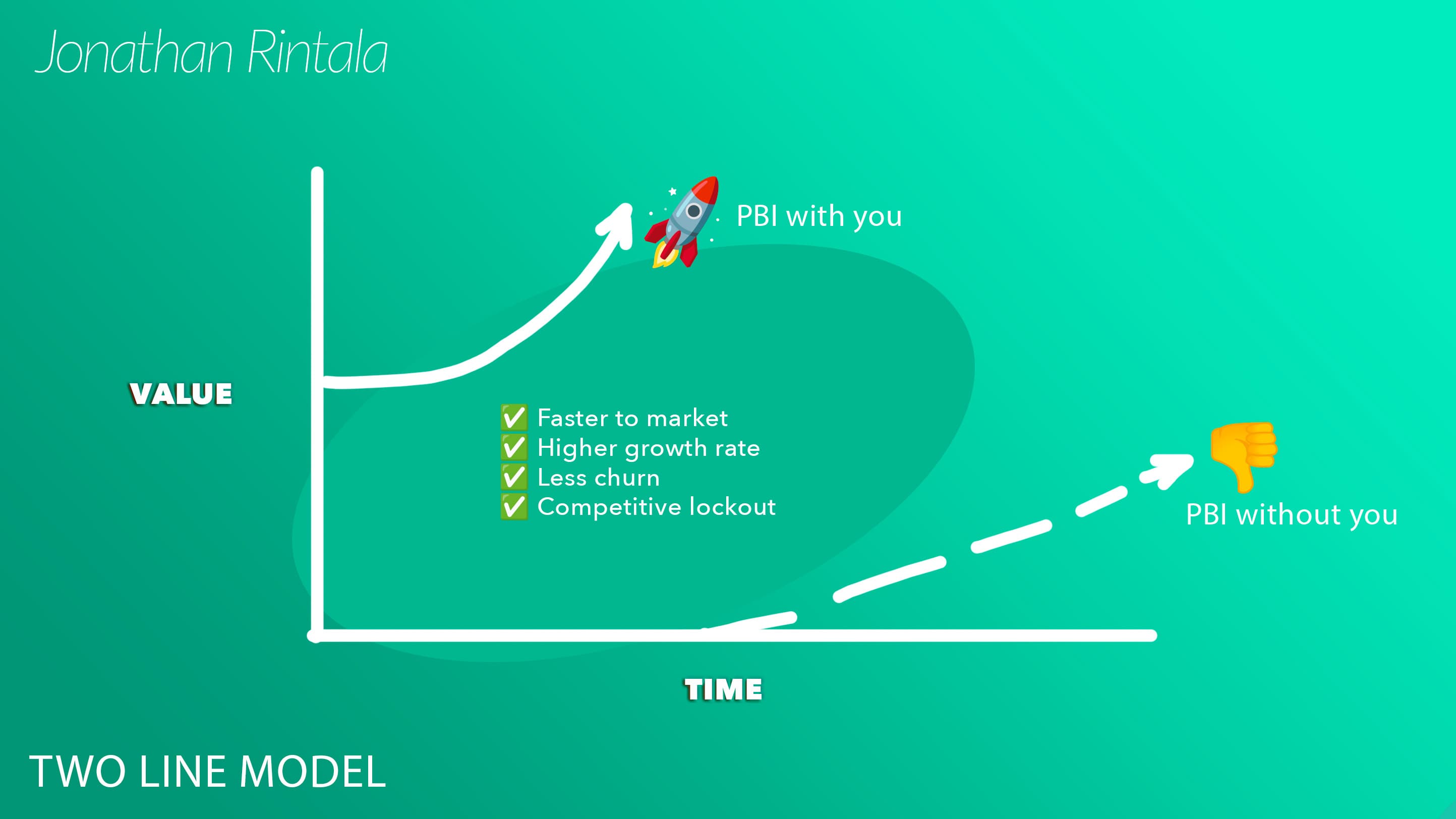

TLM | Two Line Model | A model you use to compare a future including your company vs. a future without it. Showing the importance of the benefits of buying your company - future cashflows, customer retention, etc. |

Startups are bought, not sold

Ideally, you should never sell a startup - you should be bought. When the buyer comes to you - the power is in your hands. The buyer has already made up their mind, envisioned the strategic value they will get from the procurement. The effort to buy is worth it.

What can you do? If you have time, start building relationships with industry peers and PSP:s (Potential Strategic Partners) early. Put yourself on their map and position yourself as a market leader they want (need) to work with to succeed.

Pace yourself, keep cool - let them ask the golden question: “what are these guys really after?".

In reality, this is not always the case - thus, there is also the "fast track approach" below.

Tool 1: Market Leadership Positioning 📍

Definition of what supremacy looks like in your unfolding market, shared in a smooth way.

What value will you create together? Why is it awesome? Keep it short, compelling, and sweet. This is your common North Star.

Just like A-players attract other top employees. The PSP:s want to partner with the hottest market leaders in the space - who know their stuff, carry themselves, with the happiest customers and most innovative tech, and that drive the space forward. Make sure you are someone people want to partner up with.

Soon you will reach the ultimate level of the strategic partnership ladder - ie. a full fledged acquisition.

Tool 2: Two Line Model 📈

Graph showing your PSP what a future looks like (A) with your company 🚀, (B) without your company 👎.

Inputs to the TLM should be few and big - you want your message to be crispy.

Tool 3: The 3 M&A keys 🔑

The three keys that are needed to make an acquisition happen. Lack one or more and the deal is dead.

Product strategy sponsorship - Do you have a product champion at the buyer's table? Startup acquisitions are driven by product teams. This is the M&A key that rules them all.

Corporate development engagement - Are corporate development + legal available and engaged?

Executive visioning - Do you know who your executive sponsor is and their level of enthusiasm?

Tool 4: Put yourself in the buyer's shoes 👠

Remember: It is not about you - it's about them.

As founder, it's easy getting carried away thinking everyone will see the same bright future for your company that you do. Also that buying your startup will be only pros, and should suddenly be a main priority for anyone having the privilege of hearing about it.

What does it mean buying another company? Well, it means sacrificing other strategic priorities, long painful legal work and due diligence, less profitability, lots of risk, problems with merging in a new team, etc. But it can obviously be an awesome win-win in the end.

By putting yourself into the shoes of the buyer, you will figure out a lot of the unknowns you have to eliminate to de-risk the purchase on behalf of the buyer. But also the magnitude of the benefits needed to go through with all the hassle of buying your startup.

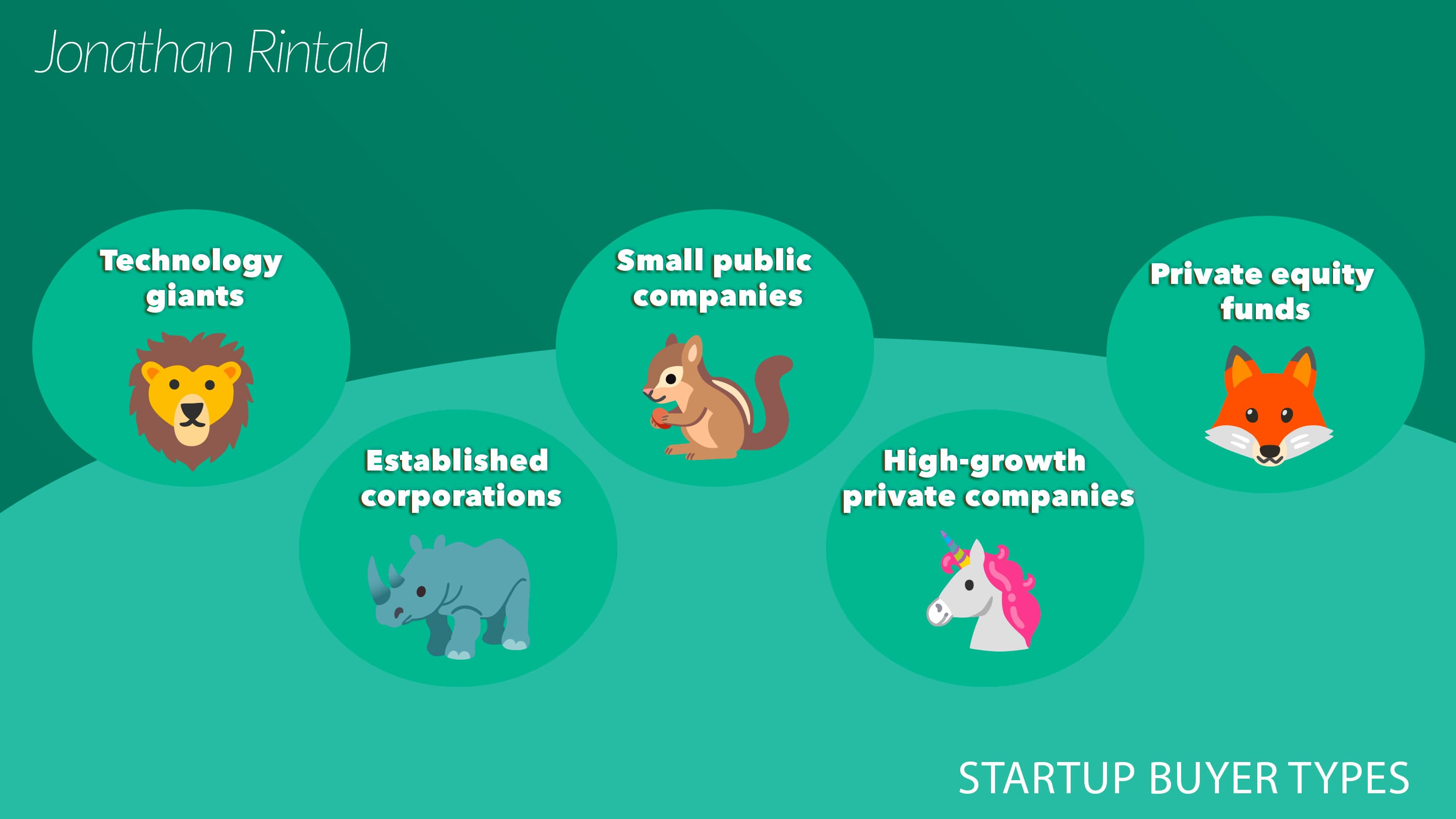

5 types of startup buyers

Understanding the buyer helps you understand what their priorities will look like. There are generally 5 groups of startup buyers.

Technology giants: they understand magic boxes, how to buy startups, and can be flexible on valuation. They value talented teams and might consider acqui-hiring.

Established corporations: they can be challenging buyers, as they are not comfortable placing big bets on still-to-be-proven ideas + often valuing businesses based on operating profits. If stars align - they might see you as a rare magic opportunity to do something big.

Small public companies: they have the magic-box DNA, but often on the edge of profitability, market is focused on short-term performance and their changes in their income statement. Being profitable (or close) is important.

High-growth private companies: they are quite ideal startup buyers, working on their own magic box mission, they have momentum and resources. You just need to buy in to it. Often want you to take their stock as payment.

Private equity funds: PE is a different type of buyer vs. an operating company. PE generally want to buy companies they can incrementally improve, and predictably grow. They buy companies for a living. Sometimes will consider your startup as part of a portfolio company.

5 buyer concerns

Understanding the buyer involves what they will consider when looking at the opportunity of buying your startup. Generally there are 5 concerns the buyer will evaluate - that determine the likelihood of the deal happening and the valuation of your company:

Buyer utility: the buyer's view of your startup's impact is the biggest factor in valuation.

Capacity to pay: the access to capital decides how a buyer would approach a deal - good signs is if they trade at a high multiple in the public market, have low debt, or large cash reserves.

Sponsorship, focus & urgency: the more senior the executive support, the fewer hurdles the acquisitions will have to clear. Have the CEO say "let's just get this deal done!" Does the buyer feel compelled to do the deal right now? Urgency matters. Why can't a commercial partnership fulfil their current priorities?

Cost to own: the cost to operate your statup is a big consideration for the buyer. What will be the operating costs, when bumping salaries up to similar roles in the buyer's organization?

Ease of transfer: the friction to transfer team geographically, any customers that might have signed exclusivity deals, and the tech.

The fast track - selling your startup in no time

Short on time? Here is the process to get things done fast. However, note that it might not get you the perfect valuation or dream outcome. But, for a lot of startups this is the reality.

The accelerated approach consists of 3 phases.

Phase 1: Awareness

Phase 2: Relationships

Phase 3: Activation

Phase 1: Awareness

Goal: identify the right person and find a way to get your story in front of them. Get on their radar.

Create a list of potential PSP:s. It may range from a 10-100. Make as long a list as you can. Organize the list by sector. Consider adjacent markets - with companies that might want to enter your sector. Don't exclude other startups. Score by:

where you feel your startup could add the most value

existing relationships vs. need to start developing them

Don't charge out of the gate with an acquisition-or-nothing approach. Keep conversations open-ended.

Even if this phase is short - go through the top targets to learn more about them and have them learn about you. Don't apply too much early pressure without any relationship in place.

Once you have their attention

Push for a more formal presentation. Include a few people from their organization if possible - to get things moving faster.

You don't need to say you're for sale or put forward a specific form of ideal relationship - they will probably get the idea what you are looking for anyways.

Keep interrogatives brief and the meeting conversational - dive in after they have introduces themselves. Speak about what interested them - cover specific areas they mentioned in their introduction. Talk about the big new idea.

Roughly 20% of discussions end up being somewhat a fit - between your startup's intended direction and what the PSP has considered themselves.

Phase 2: Relationships

Once you've been introduced - the next phase is developing the relationship.

The conversation may be about (A) a potential acquisition (B) a potential partnership, or simply (C) topics from your thought-leadership game on LI. Either way, make sure the conversation builds towards a PBI.

The middle phase is typically where the best stuff happens. When you get a hit in the Awareness phase it's typically a partial match. When you get a hit in the Relationship phase - this means the buyer is now coming to you.

The best deals happen when the buyer is coming to you with everything figured out on their end. The challenge is it might take weeks or years. If you don't have the time - jump to phase 3.

Phase 3: Activation

Ideally, you can wait with making an push and activating until you have an existing relationship. Maybe a few PSP:s that you have had open-ended discussions with, or developed commercial partnerships with. You are not a random unknown company rushing in the door trying to get a deal done overnight.

Use FOMO to move you up their priority list

Activation means you are playing more on loss aversion than opportunity maximization. Relying on FOMO to move your startup up the priority list of the buyer.

In the Activation phase - you are relying on them not wanting you acquired by someone else. Maybe if you have a previously established partnership:

They may have developed a dependency on your startup

You are in an area they know they need to address, and they are worried about a competitor leapfrogging them

You can get deals done in this stage. But FOMO doesn't typically drive the same valuation you see in the Relationship phase.

Have the data prepared and hit your targets

Prepare as events can unfold quickly once you hit activate. You have to be in front of, not behind, the action. Have your presentation, supplemental materials, and data room ready.

Spin up a handful of concurrently interested potential buyers - you will not manage more at once.

Sort your targets into 3 buckets:

Top candidates: clear need, strong relationships, only need a nudge

Direct competitors: hold off on these for now, approach them in extreme situations (if at all), they represent a great deal of risk

Everyone else: longshots that have to raise their hand and show interest, don't over-invest in this category

Use time as leverage - put a date out there

Set a specific time when you need them to show interest by. Target 3-4 weeks out.

Communicate roughly: “The highest best use of our innovation will be most likely be realized together with larger commercial entity”.

“Safe way” to use time as leverage.

Get one to move preemptively, if you have several targets.

Bonus move: the threat of the date

If you have a target you think you can activate fast - tell the PSP that (A) you aim to go into a period-certain process in the near future, (B) you want them to look first at the opportunity, and (C) they have a chance to make a pre-emptive offer now.

Set everything up for full execution of deal - have ALL supporting material up-front => look ready-to-go => urgency.

Note: Avoid bluffs based on fictive suitors.

Sometimes your situation requires to accelerate and move quickly. But that doesn’t mean you can’t incorporate a number of aspects from the MBP.

The full book: Is the Magic Box Paradigm available as PDF?

If you are interested in reading the full book - the Magic Box is available both as paperback and e-book. You can find it on Amazon (Kindle version or paperback).

Conclusion

Startups are generally built to eventually be sold. Thus, this was a fantastic read for any founder interested in building (and at some point selling) startups. There are a ton of areas to cover when it comes to startup acquisitions - and The Magic Box Paradigm got it all covered.

As a startup founder this process should start from day 1, building relationships, partnerships, etc. It's not just something for when the time comes when you practically think about selling - then it's too late.

Frequently asked questions (FAQs)

Q: Who is Ezra Roizen?

Ezra Roizen is the founder and general manager of Advsr an advisory firm helping startups build big ideas with potential strategic partners. Ezra is a partner with Ackrell Capital a boutique investment bank.

Q: Is the Magic Box Paradigm: A Framework for Startup Acquisitions available as PDF?

If you (A) think the summary of Magic Box Paradigm: A Framework for Startup Acquisitions above is not enough, or (B) the summary makes you crave the full book - you can also find the PDF or Epub versions at Amazon, or your nearest bookstore.

Want to learn more about growing SaaS companies?