Built to Sell - Summary and review

🚀 Summary: Built to Sell in 30 seconds

Contents

What is Built to Sell about

This is a guide on creating a business that don't need you to run, can grow without you, and exit for a big multiple. Check out these 15 tips on how to sell your business. And how to build a SaaS or startup that can make you a millionaire.

15 tips on selling your business

Here are the 15 tips that the Built to Sell book talks about, in order to sell our business for a big multiple.

Note that this work starts way before you actually want to sell. As Magic Box Paradigm puts it "startups are not sold, they are bought".

"Startups are not sold, they are bought"

- Ezra Roizen, Magic Box Paradigm

Ideally, you should start implementing these the same day you start your business. When the day comes to sell, you will have built an attractive business that does not depend on you, and can exit for a big valuation to a variety of actors.

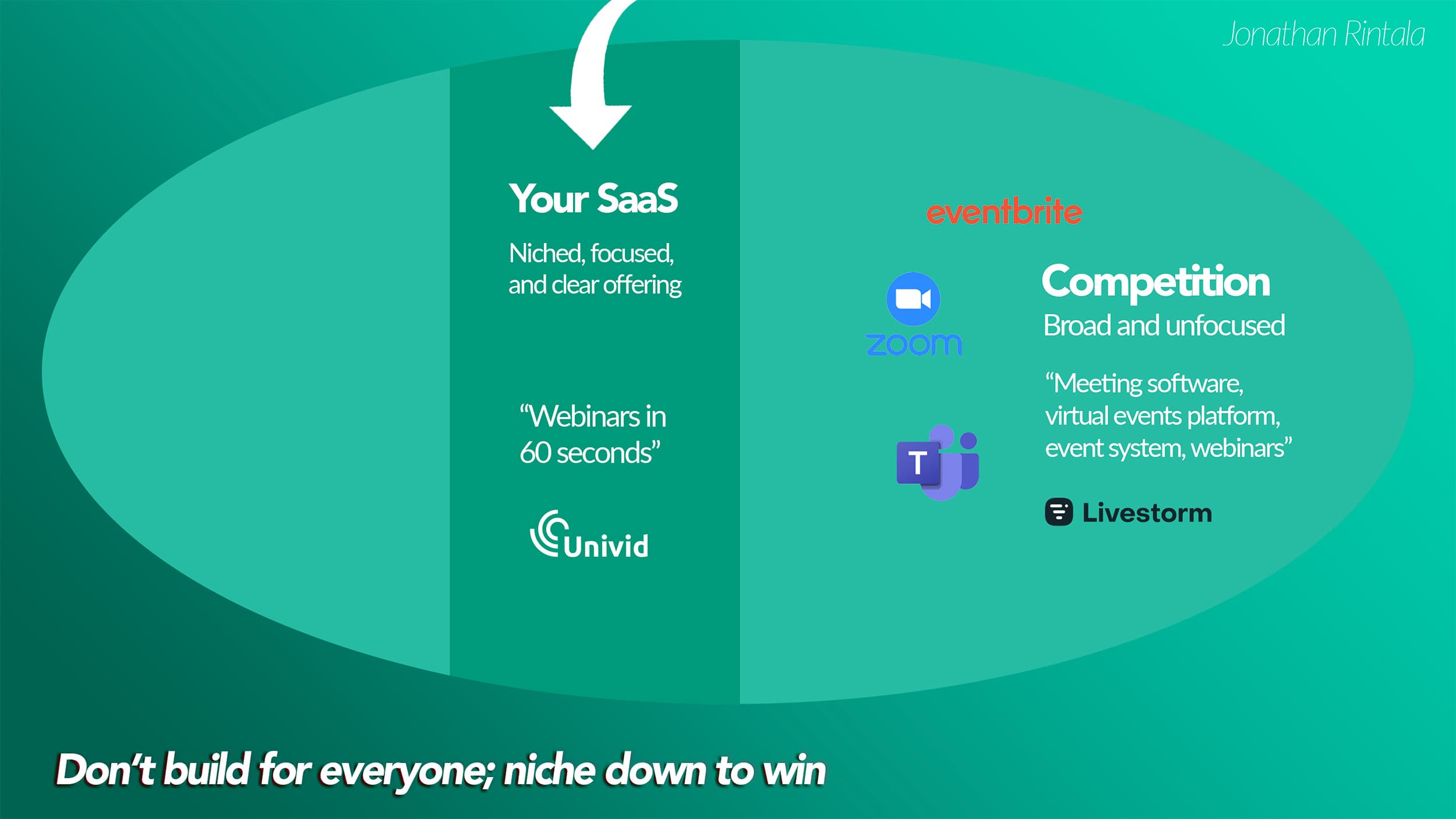

1. Don’t generalize; specialize.

If you focus on doing one thing well and hire specialists in that area, two things will happen - the quality of your work will improve, and you will stand out among your competitors.

Example: The SaaS I'm building, Univid - we have focused down heavily on one use-case - hosting engaging webinars really fast and easy. Instead of trying to please everyone and be just OK at everything.

2. No customer should be > 15% of your revenue

Relying too heavily on one customer is risky, and will turn off potential buyers. Even if you are targeting the enterprise segment.

So, make sure that you diversify your customer pool in terms of contract size.

The golden rule: "Don't let any one customer make up more than 15% of your total revenue"

- John Warrillow, Built to Sell

This also validates more people want your solution, and that you are not ending up a consultancy (service category) building for one client. Service companies suck in terms of exits - because they (A) sell for much lower multiples, and (B) require longer lock-in and earn out than SaaS.

Rather you want to build a platform, ideally one you charge for recurring - typically according to a SaaS model if it's software. SaaS exit on big multiples (often >X6 ARR) and generally don't require as much lock-in or earnout.

And with a diverse customer pool you reduce the risk for potential buyers even further.

3. Have a razor-sharp offering

Branding and positioning is hard. It's infinitely times harder with multiple brands or an unclear offering.

This is something Rand Fishkin, founder of Moz, talks about in his book Lost and Founder. They went to broad to quick with Moz, and desperately had to cut all sub products in their portfolio except one, to keep their core business and growth.

Takeaway: be clear about what you’re selling, and potential customers will be more likely to choose your product. Position your SaaS to win.

A good read to deep dive into positioning is Obviously Awesome by April Dunford.

4. Make things run without you

Don't attach yourself to your company too much. Make sure that operations and growth can happen without you.

In other words, make sure you are easily replaceable.

For example, that:

qualified leads keep on coming without you being present.

someone else can run sales, demo your product, and close deals.

your code base is easy and clean - that "anyone" can take over and contribute to.

someone else can keep your customers happy.

If buyers are not convinced the business can run without you - they won't give you their best offer. And force you into long lock-in and earnouts if they make you an offer.

5. Cash is king

Stay on top of cash flow to avoid the cash suck.

Create a positive cash flow cycle - by either charge up front, or use progress billing.

6. Say no, keep scope tight

Learn to say no to projects and customers. By saying no, you:

prove you are serious about your niche

you reinforce your focus internally and keep your product niched

prospects refer relevant prospects to you as your offering is crystal clear.

Also, by saying no you, avoid bringing on customers that will not be happy with the experience and only drain time and energy, by wanting functionality you will not or should not develop anyways.

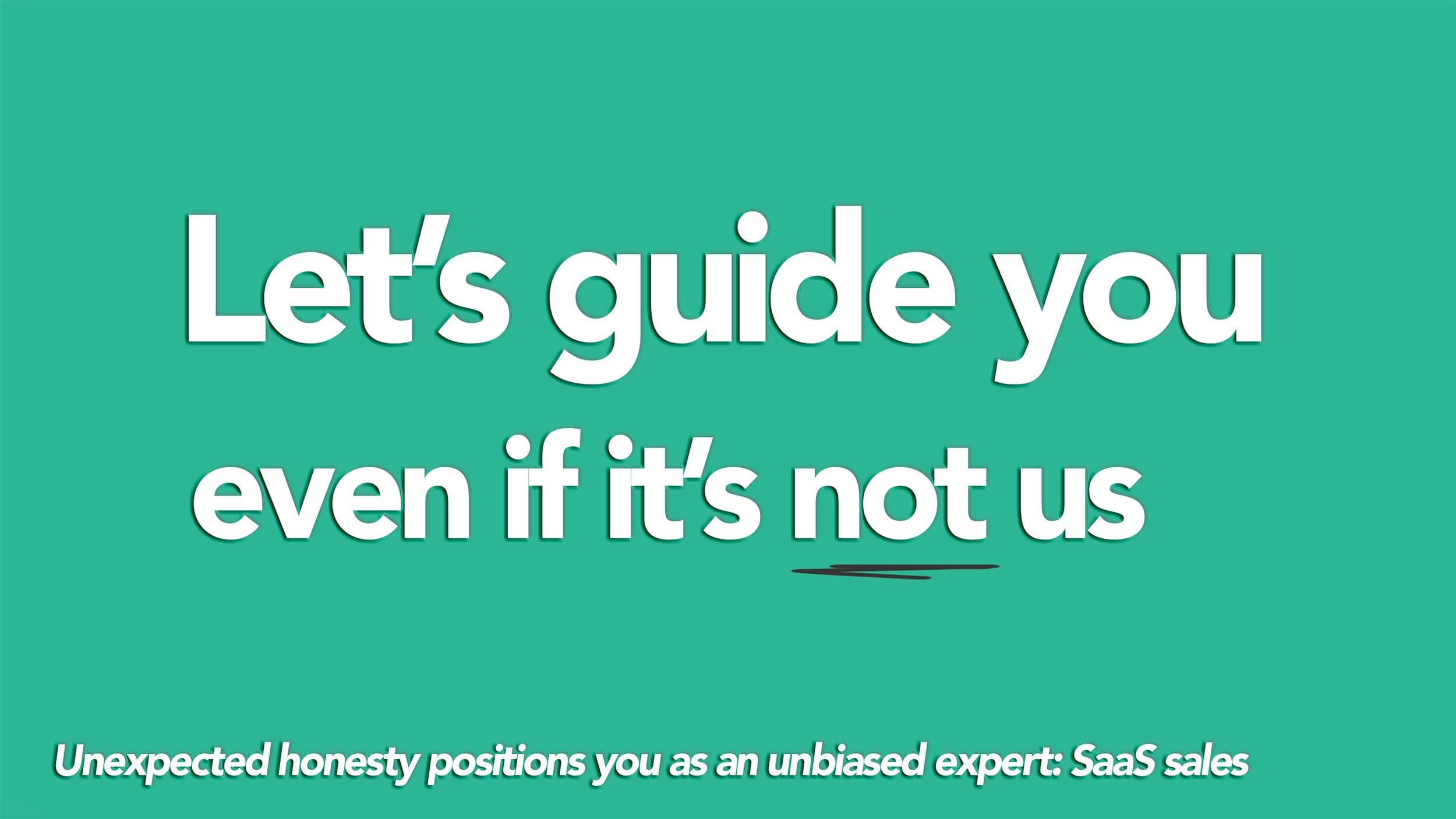

Taking it one step further: recommend another solution

A next step that The Transparency Sale talks about is also, instead of just saying no - to also recommend another better solution in cases where it's not a fit. Even if it's an adjacent competitor.

This "unexpected honesty" gives remarkable results, as it positions you as an unbiased expert looking to help them find the right solution, even if it's not yours - instead of a sleazy sales rep looking to sell at any cost.

I do this in demos and it often catches the prospects off guard and allows them to open up more about their genuine needs or objections. Often they even refer another better fit prospects themselves, as a way to "pay back".

7. Know your conversion rates

How many prospects in your pipeline convert? Know your conversion rates. For example:

If you run a demo: From MQL or SQL -> demo. And from demo -> customer.

If free trial: From lead -> free trial signup. From free trial signup -> customer.

That will eliminate uncertainty and risk for the buyer. And help them estimate the size of the market opportunity.

![Conversion rates in SaaS [example] Conversion rates in SaaS [example]](/_next/image/?url=https%3A%2F%2Fimages.ctfassets.net%2F0ck4z1m88rve%2F5WufKdneolbVc5Ee3KZObj%2Fe50410f1ae27f401f8dd9fc66440eafb%2Fconversion-rates-saas.jpg&w=3840&q=75)

8. Two sales reps are better than one, always*

If you are running a SLG motion, two sales reps are always better than one. A few reasons why this works:

Sales reps are naturally competitive, and will thus try to outperform each other.

You can easily benchmark and fire fast if one does not perform.

You prove to a buyer that you have a repeatable sales model.

* If you are not running SLG, or need more sales reps to increase results in the first part - not hiring at all is obviously better - as it proves you don't need more FTE:s to grow. That's how we grow Univid to millions of dollars being a team of 2 people - where we run a highly automated and scalable PLG motion, without the need to scale using more FTE:s.

9. Hire sales reps that have sold products, not services

So you decided to scale your business through SLG, and need to hire sales reps. John Warrillow recommends to hire people who have sold products, NOT services.

Why?

Sales reps who have sold products will look for ways how your product can meet the prospect's needs. Rather than agreeing to tailor your product to fit the individual needs of each prospect.

Thus, you will put together a team that naturally will contribute to building a scalable platform - not a service.

10. You need 2 years of P&L before you sell

Typically, a buyer expects to see at least 2 years of financial statements and P&L with your standardized offering before you sell your company.

Again, reducing their uncertainty that the model works and you have real proof of traction.

11. Build and incentives management team long-term

Put together a management team to give the company a stable leadership and autonomy. Offer these people a long-term incentive plan - that rewards their long-term incentive plan that rewards their personal performance and loyalty.

Warrillow suggests to give your key staff clear incentives in the M&A process as well. Preferably as a simple cash bonus split in two components - where they get (A) a cash reward if you sell the company (B) a cash reward if they stay throughout the transition.

Note: Often in high growth SaaS companies you will have established an option program early on - and then that would be equivalent to the above.

12. Find the right adviser

Find the right adviser to help you sell the company. You should look for an adviser:

where you are neither their biggest or smallest client.

they know your industry.

want to competitively get the best deal possible from several buyers.

Keep an eye out for advisers that offer to broker a discussion with a single client, and think about their incentives if they have strong relations with the buyer side and want to "serve them a good deal".

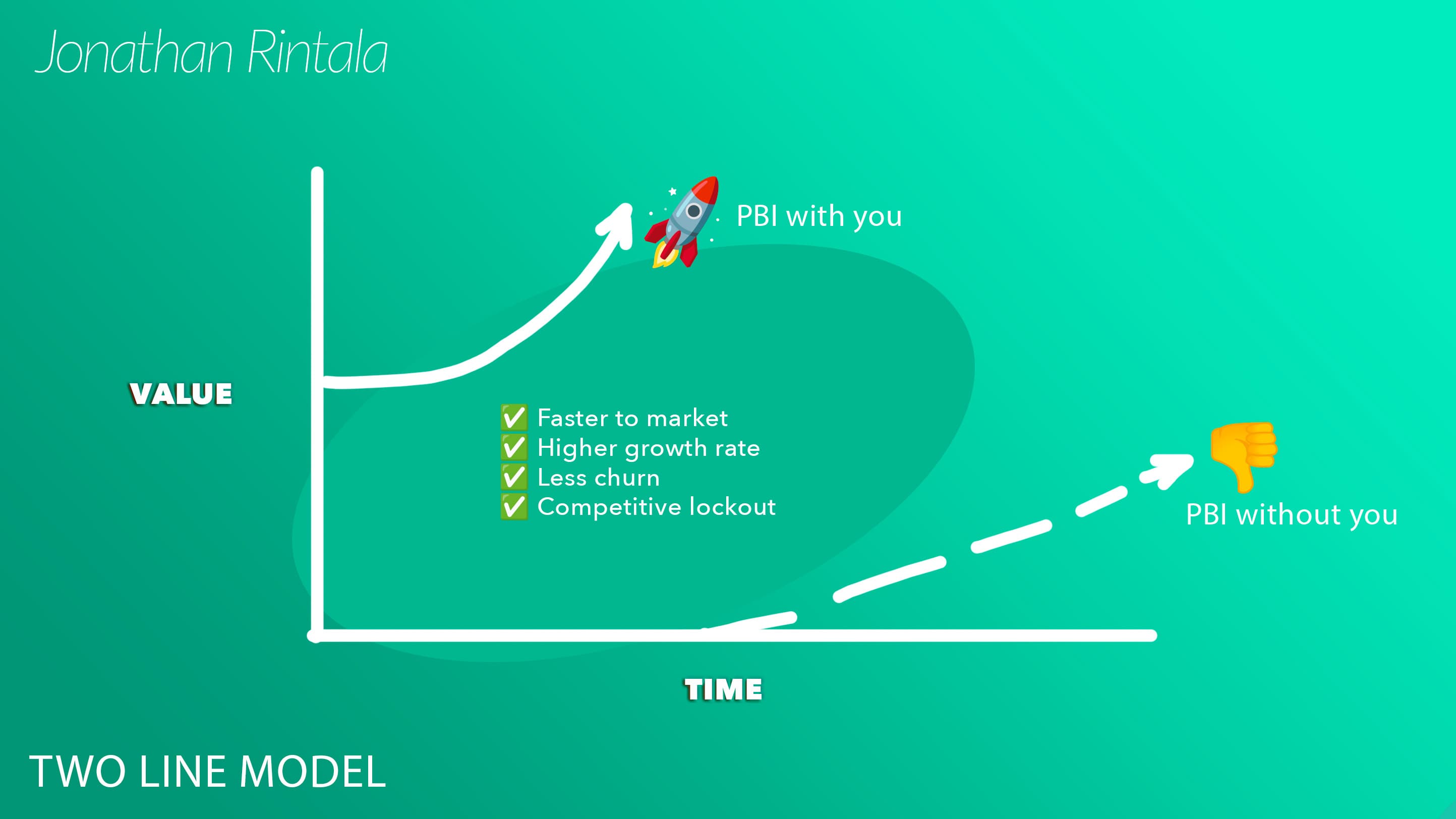

13. Think big and paint it out

When it comes to painting a business plan for the acquisition. Think big and write a 3-year business plan. It should paint a picture of what is possible for your business.

Also take into account that the acquirer will have more available resources for you to accelerate your growth.

The Magic Box suggest to do this exercise together with the buyer and create a Partner Big Idea (PBI) - a mutual plan. And then show the progress with or without your company in the equation.

14. Talk in SaaS, talk their language

If you want to be a sellable, product-oriented business, that exit for a SaaS multiple - you need to use the language of one.

If you transitioned from a service-oriented business - change words like “clients” to “customers” and “firm” to “business.” Also, clean up all your front facing website, customer communication, and socials to not reflect any old generic service business language - if you transitioned.

You want to understand the buyer and talk a mutual language - find out what terms they are using on their website, etc. and mimic it. This allows you to connect and makes you feel like an insider from day 1.

15. Ignore P&L when transitioning

So, Built to Sell has some focus on transitioning from a service-oriented business to a standardized offering (SaaS).

Warrilow's recommendation during the first year of transition - is to ignore the P&L (profit-and-loss) statement. Even if it means skipping out on bonuses.

As long as your cash flow remains strong and stable, you’ll be back on black numbers in no time.

Conclusion

Built to Sell is a great resource on building a business that stands on its own, and can be sold at a good multiple. It focuses some parts on transitioning a service businesses into recurring revenue. But provides solid tips for SaaS founders too.

All the tips were legit and provided good reminders on how to build a sellable business. Things like niching down hard, daring to say no to bad fit prospects, building processes, hire for scalability, and prove the things you need to eventually get a great exit.

But also, things in the exit process itself - like talking in the language of the buyer, making sure you can show them what they need to see, and apply some pressure.

Buy the book: Built to Sell 👇

If curious in more, you can buy the full book on Amazon: Print | KindleBuilt to Sell review - what kind of book is it?

As a SaaS founder, this was a bit basic and slighly too focused on service businesses and how to transition into recurring revenue. However, I enjoyed the fictional story format filled with tips and learnings. All the tips were legit and provided good reminders on building a sellable business. I recommend reading Magic Box Paradigm after this one - that's a bit more in-depth on the ins-and-outs of startup exits.

Frequently asked questions (FAQs)

Q: Who is John Warrillow?

John Warrillow is the creator of The Value Builder System and author of Built to Sell, The Automatic Customer & The Art of Selling Your Business. Throughout his career as an entrepreneur, John has started and exited 4 companies.

Q: Who is the ideal reader of Built to Sell?

Built to Sell focuses slightly on the transition of going from a service oriented business towards SaaS / or recurring revenue. So if that's you - some of these tips will be even more relevant. As a SaaS founder myself, I found this book highly relevant too.

Want to learn more about growing SaaS companies?