I turned down a $1,000,000 offer for my startup (14 M&A learnings)

Contents

We turned down a +$1M acquisition offer for our SaaS startup. Here is what happened. And 14 learnings on M&A (some that I wish I had known at the start).

Our story

A few months ago, we got approached by a much larger competitor. Like >30X our size.

Their CEO dm:ed me on LinkedIn. We had gotten on their radar, and they wanted to meet up to get to know us and our company better.

This was the start of a process of almost 3 months going back and forth, building a relationship, flying out to meet in person, getting to know the management team, and all that jazz.

Well, I'm building a SaaS called Univid to create engaging webinars in 60 seconds.

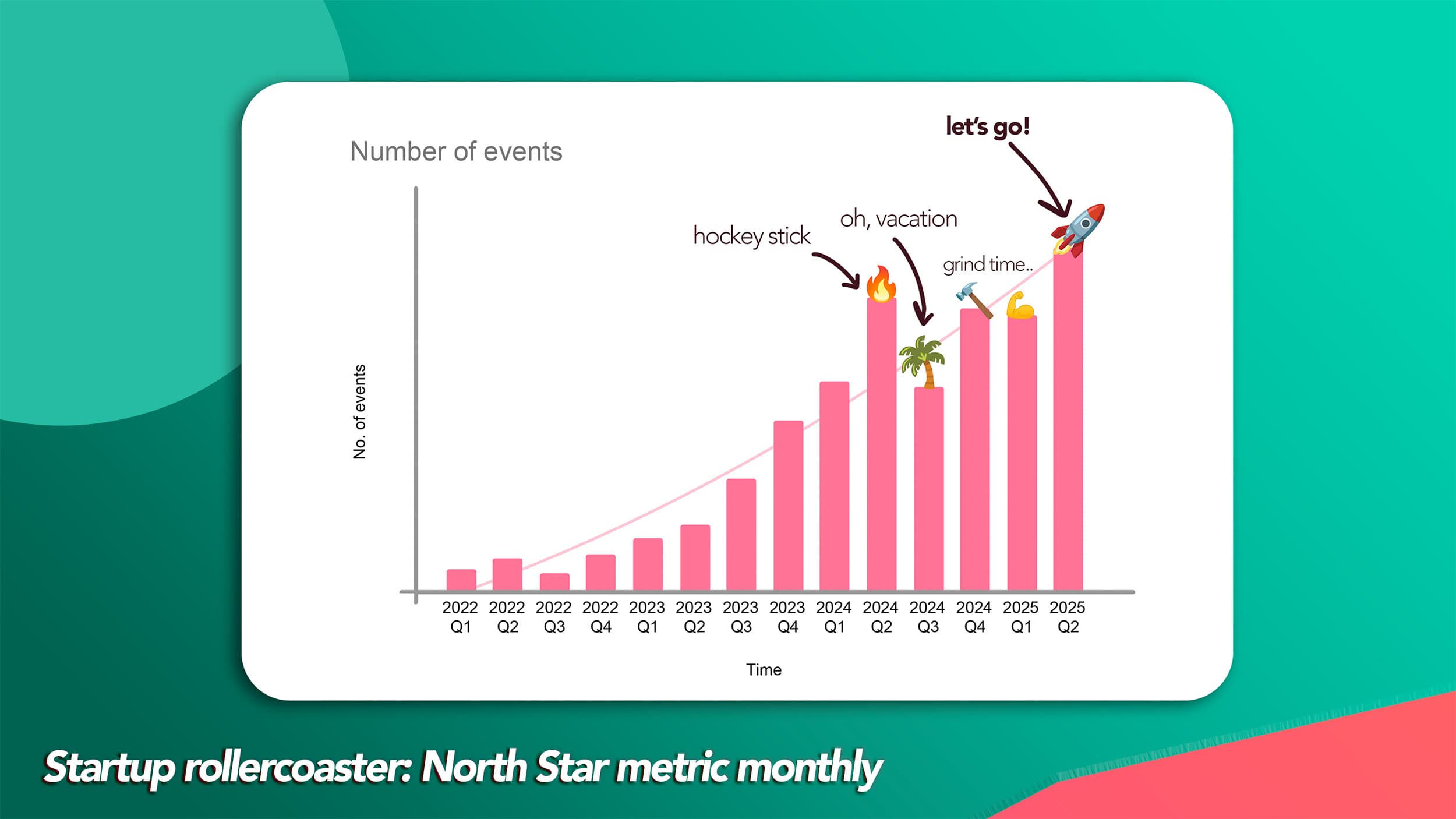

We have not thought about selling our SaaS, and have been growing nicely past ~$350K ARR the last 12 months, being lean on 2 people, focused, and profitable. And growing completely inbound. And through a PLG self-serve motion. Previously coming from a more sales-led motion.

Back to the DM. As we got approached, we went in with an open mindset, open to chat, and do a deal at the right price.

Ultimately, once we received the indicative valuation (around $1M dollars in total: cash + earnout 12 months). We couldn’t find a fit valuation-wise where it made sense for us to sell vs. continue to build.

So, we rejected the offer - and are continuing to grow standalone.

But we learned a ton..

14 M&A learnings for startup founders

Here are 14 things we learned in the M&A process of selling a startup, or rather being bought (some that I wish I knew at the start).

1. M&A takes time and steals focus

Whether you think it will or not, entering an M&A process will take up alot of your time. And steal valuable focus from day-to-day operations.

Before you dive in, make sure you are ready to spend the time, and your business will continue to run (and grow) without you.

Also, just like fundraising you need to continue showing growth and good numbers while in the M&A process. So make sure you can make it happen, and are ready to work double shifts for a while.

2. Qualify hard upfront that the buyer is serious

To avoid wasting your valuable time, make sure that the buyer is serious and that you are roughly aligned on the type of deal that is about to go down.

Qualifying questions to ask:

What type of acquisition are they looking for (strategic/acquihire/customers/)?

Do they have the firepower to pull the trigger on the type of deal you would need?

What’s the rough outline of what they are thinking financially?

Is the senior management (and CEO) on board and pushing for it?

3. What type of buyer are you dealing with

According to the Magic Box there are 5 different buyer types - and they all behave differently. So know who you are dealing with, and how they will likely act.

Are you dealing with the scaleup CEO who raised mega rounds and is a natural risk taker? Or a careful bootstrapped SaaS that always stayed profitable and never took debt in their life? They will act differently and be looking for different things.

4. Secure buy-in at the top

Get buy-in as high up in the buyer organization as possible.

Preferably, the top dog - the CEO, should be your champion. This means both pushing for the deal to happen, investing time in the common vision, and feeling big FOMO if the deal does not happen.

Also, identify other key stakeholders within the organization and get them on board. This could be:

investors

board members

CTOs

management

internal experts who heavily influence decision makers

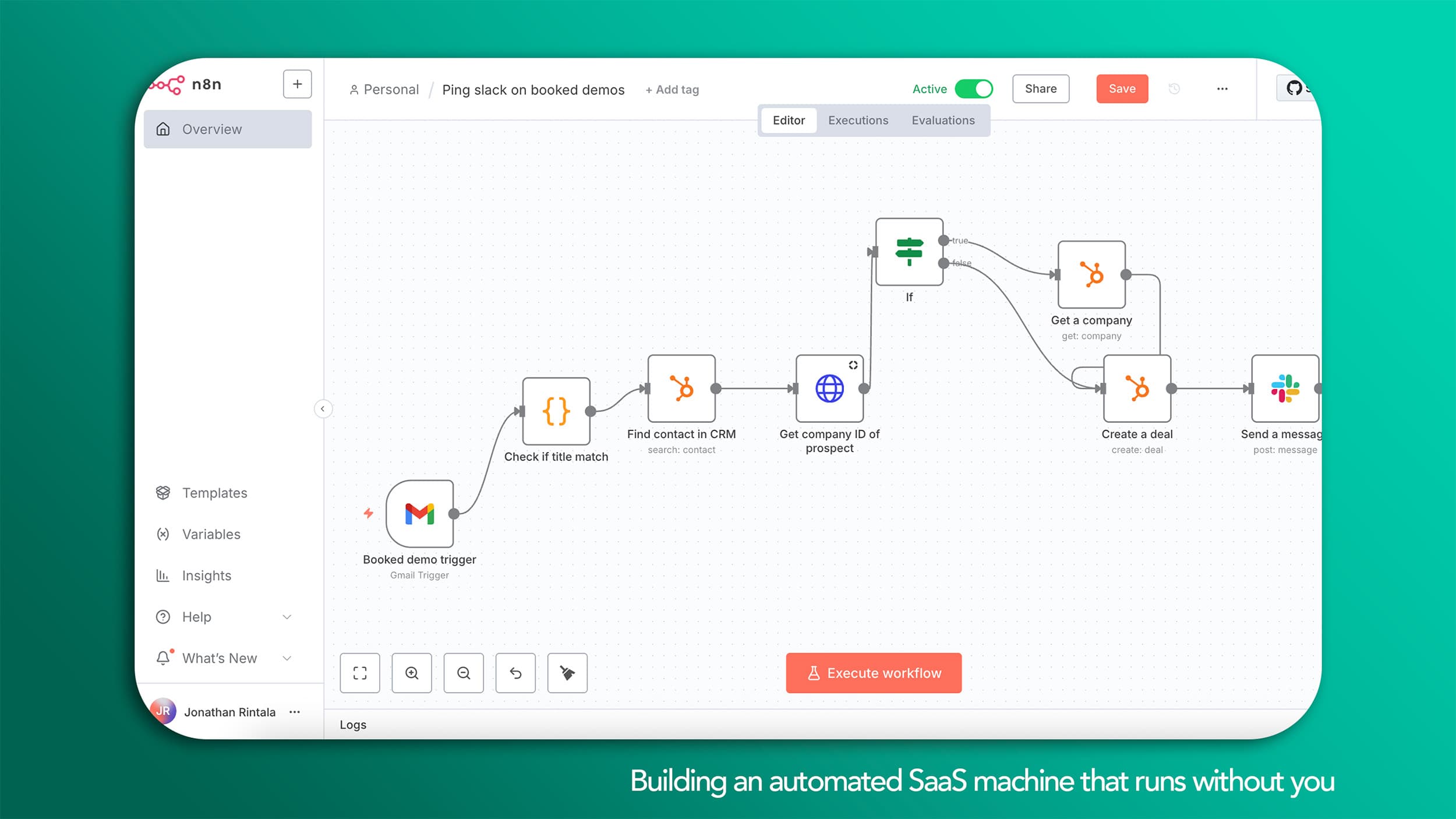

5. Can your business run without you?

Is the business highly dependent on you? Or can it run without you?

If not, some sort of earnout or transition is unavoidable as the value is tied up in your brain, skills, or relationships.

Unsure of the answer? Try taking a month off. Would there be a business to come back to? If not, automate or hire to replace you. And repeat. Repeat until you can take a vacation, forever.. (kind of).

6. Are you a need vs. nice-to-have?

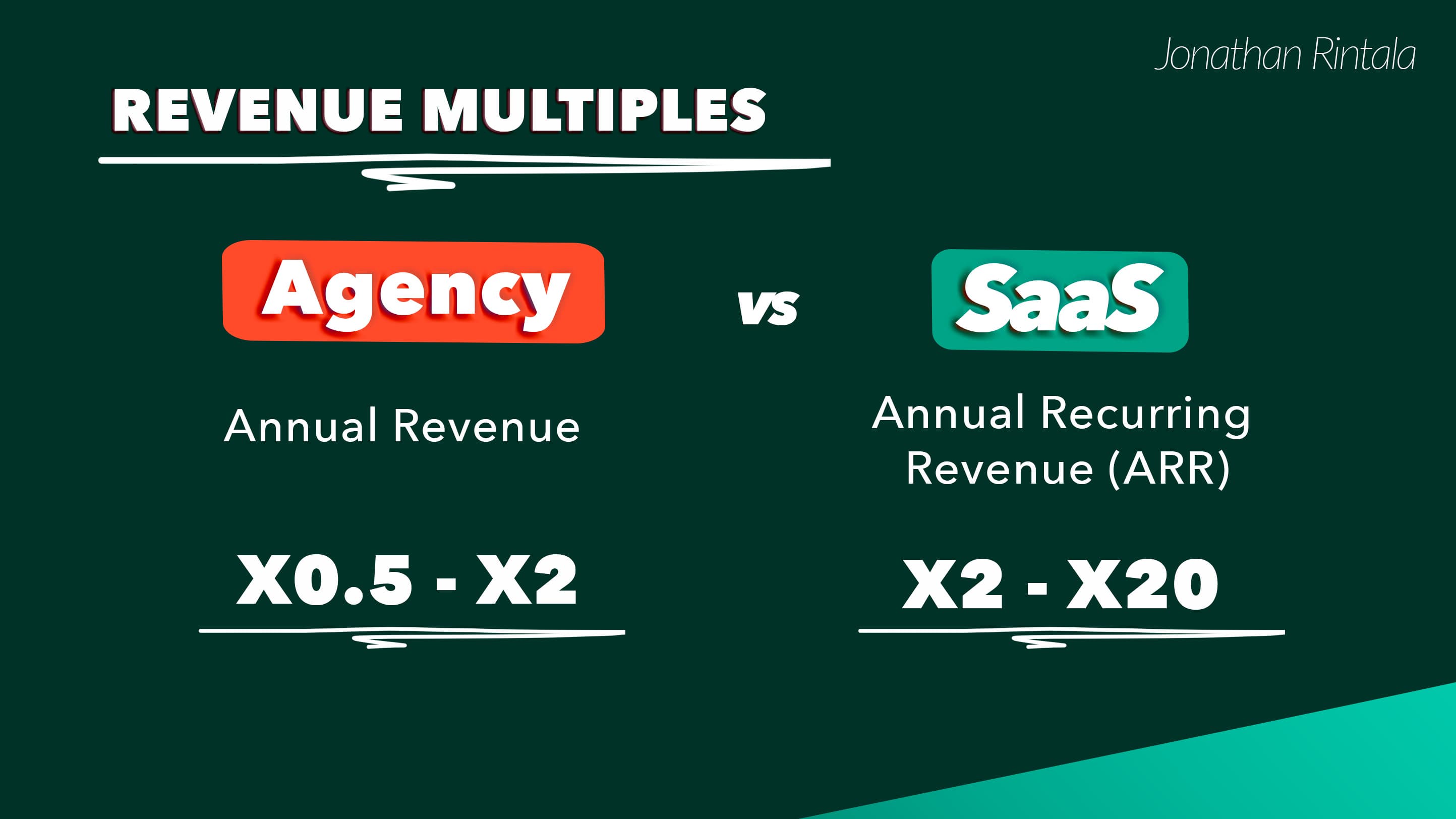

Even though SaaS, due to the magic of recurring revenue, is generally valued at somewhere >5X ARR, your business is only worth what someone wants to pay.

If someone NEEDS to buy you, ARR multiples go out the window.

Example: A friend of mine sold their scale-up while burning cash at X21 ARR. Another friend sold for almost nothing in an acquihire in a fire sale.

If the company does NOT need to buy you, then multiples go out the window, too, as you’re just a nice-to-have.

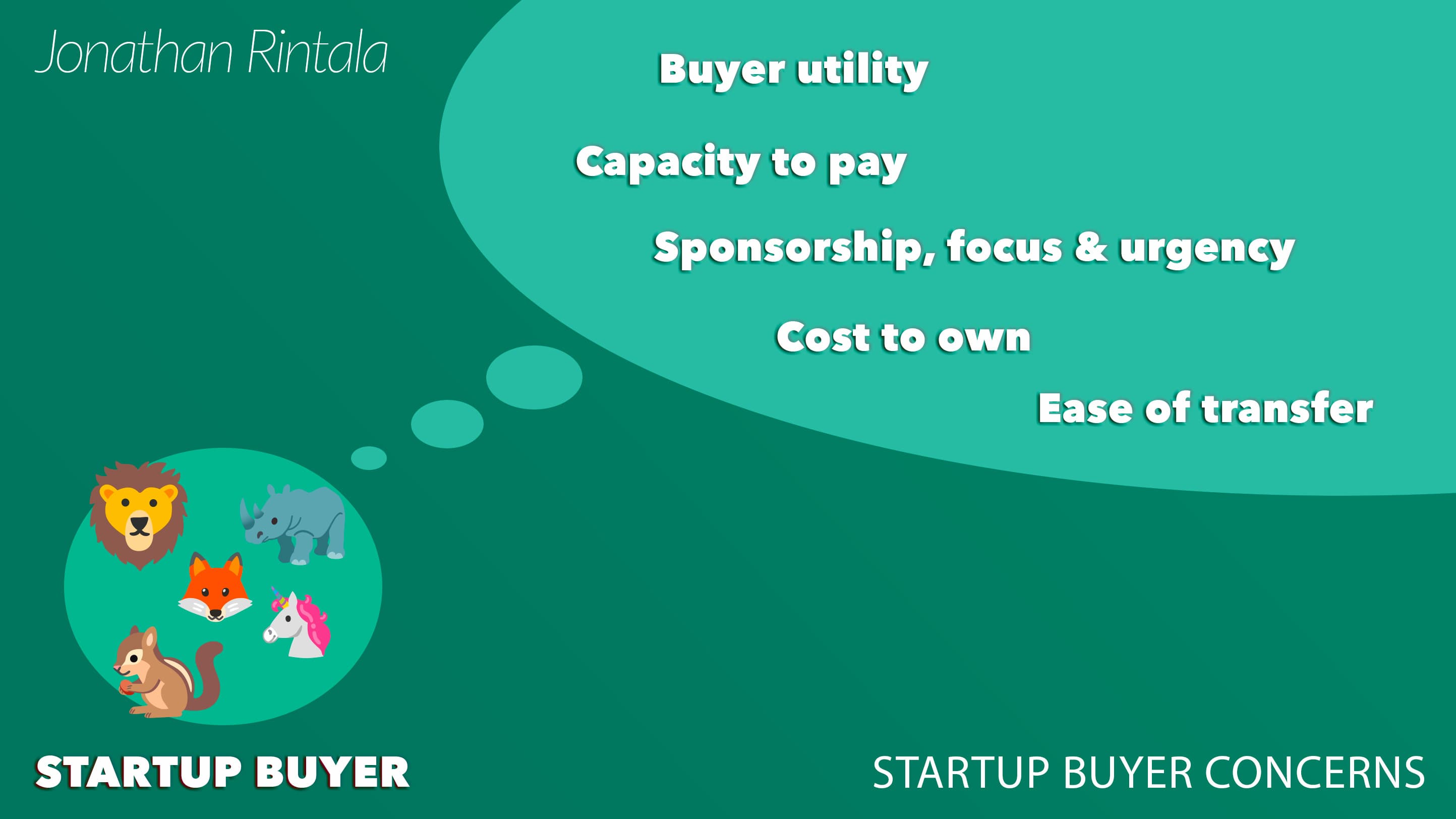

If you understand what type of buyer you are dealing with - their real concerns and upside, and you have come a long way.

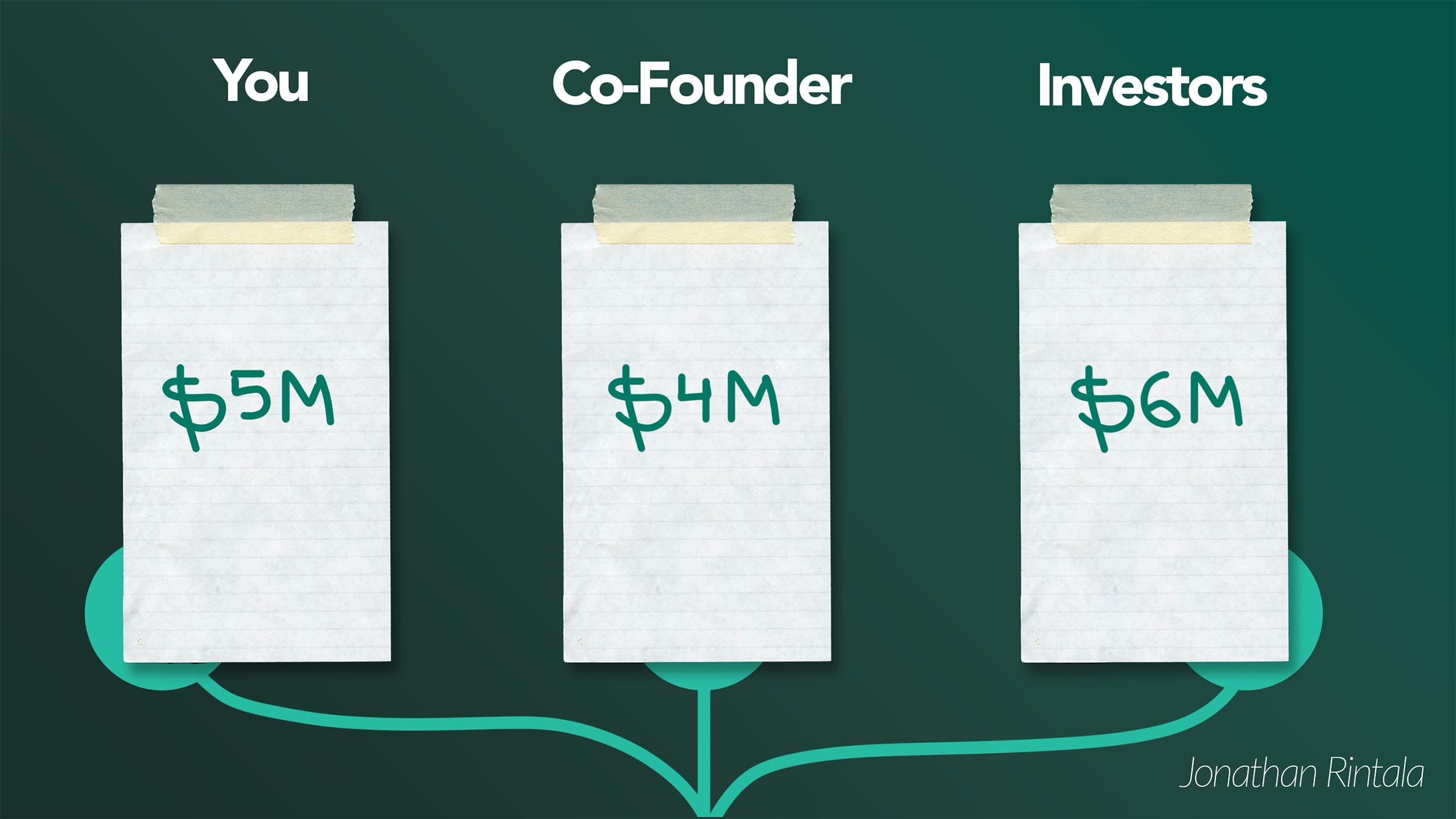

7. Write down your price before

Your business is only sold at the price you are willing to sell for. So write it down, on a piece of paper, and before you enter a M&A process.

Things will get messy, and this avoids having your emotions get in the way.

8. Align internally early on

At the end of the day, it does not matter what price you wrote down if key stakeholders don't agree. Or if you don't have the formal decision-making power.

Have exit dialogues with co-founders and your board early on. What kind of offer are you willing to accept vs not? Who has to agree formally? And who should agree to make you sleep well at night?

This will help you run an efficient M&A process - knowing what decisions you can push towards early, and what will not work.

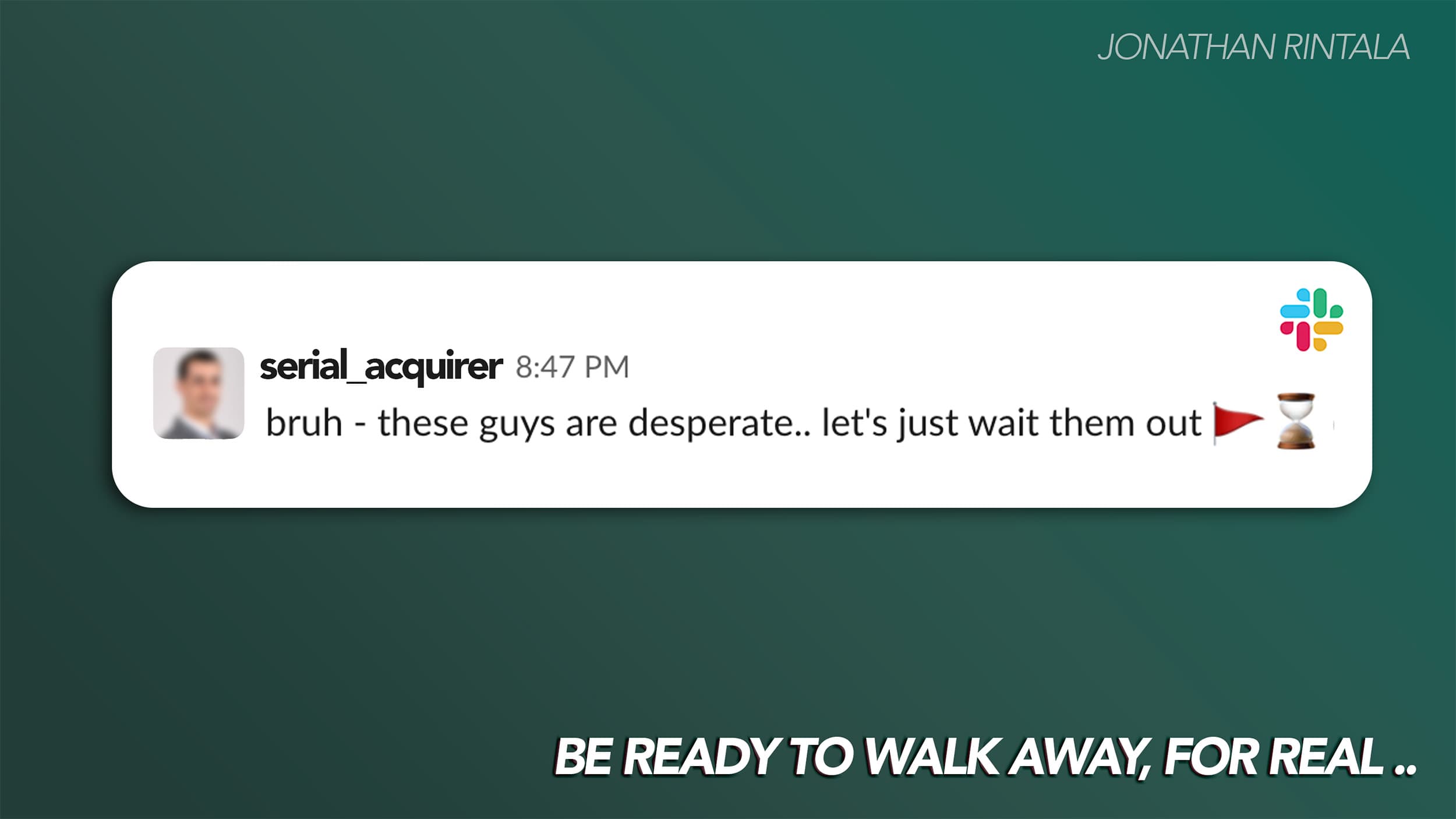

9. Be ready to walk away

Be ready to walk away, for real. That is, unless you are OK with selling below market value (or at any cost).

Remember: Desperation is easy to sense, and once the buyer does, it’s game over, and they will wait you out.

10. Be profitable and enjoy what you do

If you are printing money and enjoy the process of doing so. It becomes easy to walk away.

Enjoying what you do could mean different things for different people. But running a startup vs being employed could enable things like:

Get to solve fun problems

Have solid work-life balance

Work remotely

Fast decisions and independence

Also, if you are printing money - ie. growing and being profitable - you will naturally attract buyers (and customers).

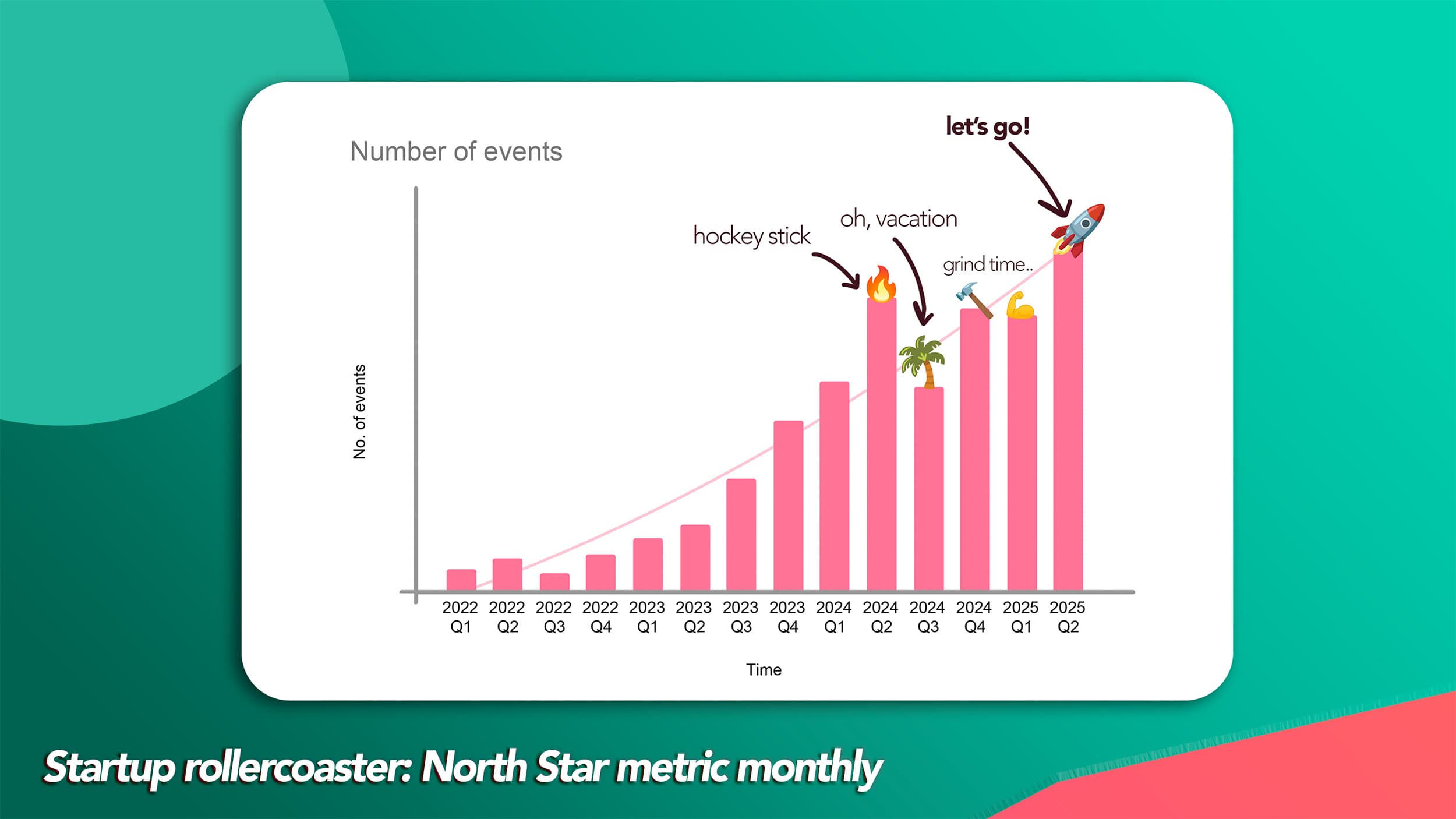

That’s how we got on the radar of the potential buyer in our scenario - we (1) smashed growth (see our growth graph of number of events above). And (2) onboarded customers in the same markets - while having >X30 times smaller headcount.

11. Sleep on important decisions

Your brain does more than dream at night; it helps you organize thoughts, solve problems, and analyze.

Don't make important decisions on the fly. Instead, take a night's rest and come back. This will help you think clearly and remove emotions from the picture.

12. Get multiple buyers onboard, always.

Don’t think it is about being polite. Don't stay exclusive unless you have to, or have an offer on the table that you cannot refuse.

BUT recognize when a good offer comes and be ready to go.

13. Don't sell your startup - get bought

Ideally, you should never sell a startup - you should be bought.

And build these relationships way ahead of time. It could be partners, integrations, agencies you work with, DM your competitors on LinkedIn, etc.

Suddenly, the timing is right, and you have your Big Picture Idea painted out together already, with the proof points already in place.

14. Relationships make or break deals

Be likable and always professional. Also, this leaves the door open for re-engaging in the future. Alot of M&A deals end up happening this way.

A few helpful resources on startup exits

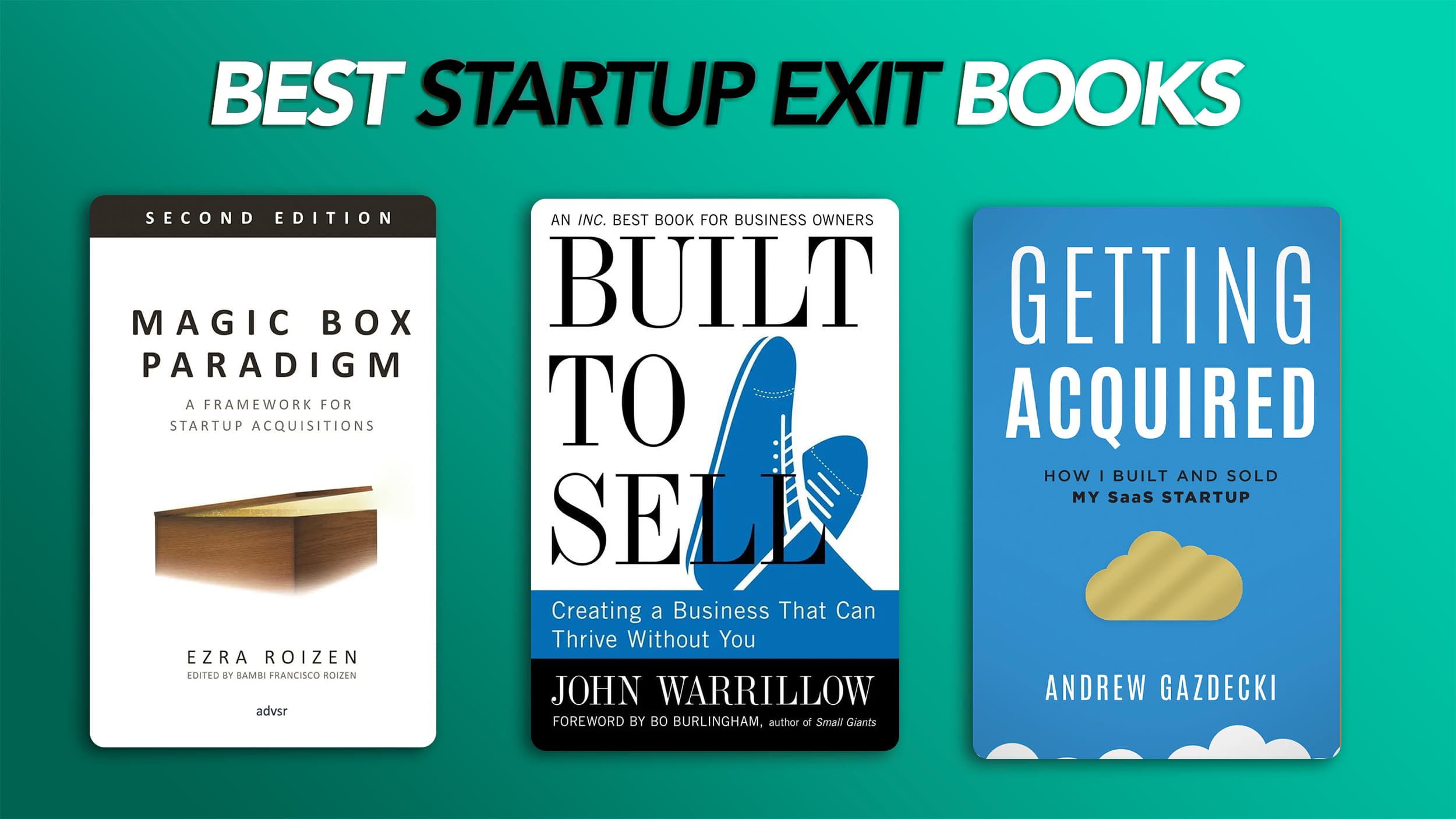

Some great books on the topic of startup M&A and exits are:

Magic Box Paradigm by Ezra Roizen - "The startup M&A bible"

Built to Sell by John Warrilow - "How to build a business that runs without you"

Exit Strategy by Rob Walling - "The emotional aspects of startup exits"

Getting Acquired by Andrew Gazdecki - "A SaaS founder's exit story (and how to do the same)"

You can find summaries I've put together of the books here (and links to the full books).

Also, some helpful podcasts on this topic are the following:

Built to Sell Radio by John Warrillow - "Exit stories with founders in all types of niches"

saas.unbound by Anna Nadeina - "Casual chats with SaaS entrepreneurs who scaled from 0 to 1, to 10, and sometimes to exit"

2 Commas by Josh Comrie - "Founder stories of multi-million dollar exits"

These books and podcasts helped in featuring real stories from real founders who have been through it themselves.

Conclusion

Selling a company or being bought can be a lonely journey. Hopefully, these 14 learnings can help other founders in the same shoes, in approaching, preparing, and entering M&A dialogues. To make some big exits happen, and feel a little less lonely on the way.

We did not sell (not this time around). And honestly, it now feels better than ever. But it was kind of an emotional rollercoaster. Looking back, it ultimately put us as founders much closer together, making us have alot of the hard discussions we should have had early on.

Also, we built a great relationship with a potential partner for the future.

Over and out. Let's make growth!

Want to learn more about growing SaaS companies?