Venture Capital: A Guide to VC

Contents

Venture Capital (VC) is a popular financing approach among SaaS startups, enabling founders to launch and grow their businesses faster than if they would have relied on revenue from customers.

What is VC?

Venture capital (VC) is a type of private equity used to support startups with high growth potential.

Typically, these investments expect to yield outsized returns - "unicorns" that reach 1 billion dollars in valuation.

However, the venture fund size determines the outcome required - as venture capitalists often require that each individual investment should be able to return the entire fund. Due to the risky nature of investing in early stages - where majority of startups go bust or don't yield favorable returns.

What's the difference between VC and PE?

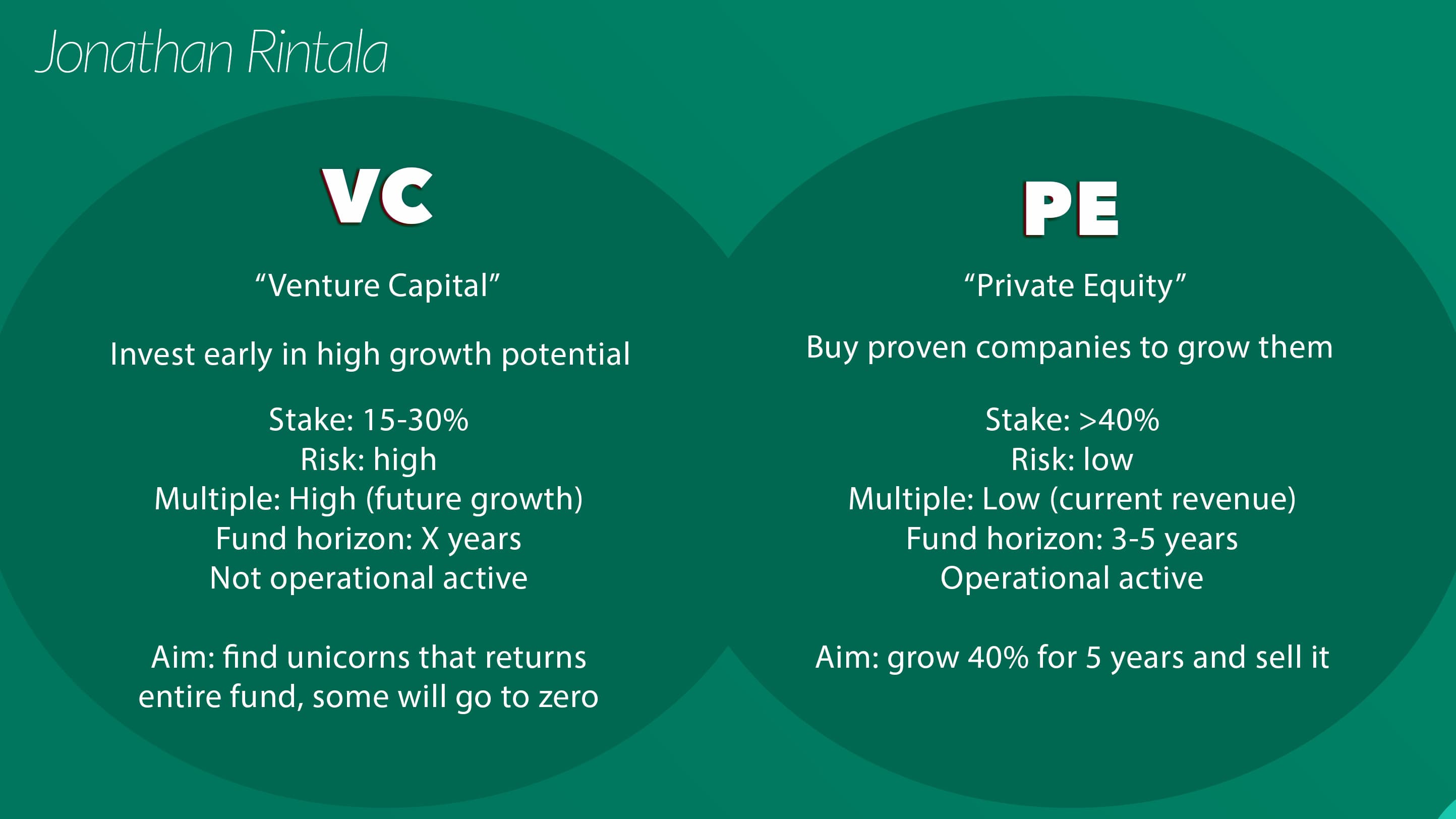

Venture Capital (VC) is a sub category of Private Equity (PE).

Private equity focuses on mature companies with proven Product Market Fit (PMF) and > $1M in ARR. Whereas VC nowadays often invest based on only a pitch deck or early signs of PMF. Here is a comparison of VC vs PE:

Examples of Venture Capital funds

Some of the most famous Venture Capital funds:

Sequoia

Andreessen Horowitz

Tiger Global Management

Lightspeed Venture Partners

Want to learn more about growing SaaS companies?