The accidental CFOs journey scaling a B2B SaaS

Contents

What my accidental CFOs journey to scaling a B2B SaaS has looked like..

OK, so first things first. I'm no formal CFO, but I've now been building a startup for 5 years, raising venture capital, and scaling a B2B SaaS from 0 to more than 100 customers in over 10 countries.

I'm an engineer by education, a creative by heart, a CFO by coincidence.

At the beginning of my startup journey, I was a naive first-time founder.

Well, I guess I still am in many ways.

In the beginning, we made some rough plans in an Excel sheet and learned everything by doing.

Seeing both what worked. And what did not.

We avoided some mistakes by listening to mentors and devouring every startup book on Goodreads.

But tbh we still did most of the mistakes in the books ourselves. Stubborn founder style.

Along the way, I learned the SaaS language - terms like CAC, LTV, COGS, ARPA, and MRR.

But, more importantly, how these things tied to the real world.

For example, I first-handly experienced:

the pain of scaling a low ACV type of product outbound.

how difficult it was to build a PLG motion that converted with a high enough conversion rate to make an impact.

more recently, how our COGS will scale to diminish towards to roughly 14% over time, as they are mostly fixed costs at our current tiny scale.

Slowly but surely, we mastered parts of the CFO's predictable playbook. And started to grow reliably. But it took YEARS.

Now we are at a point in terms of revenue and number of customers, a point where we can finally build both:

1. meaningful projections

2. and make truly data-driven decisions.

It's alot of fun once you get there. And I realize I have a lot to learn.

Some Saas KPIs we track

To stay on track, here are some SaaS metrics we track every month:

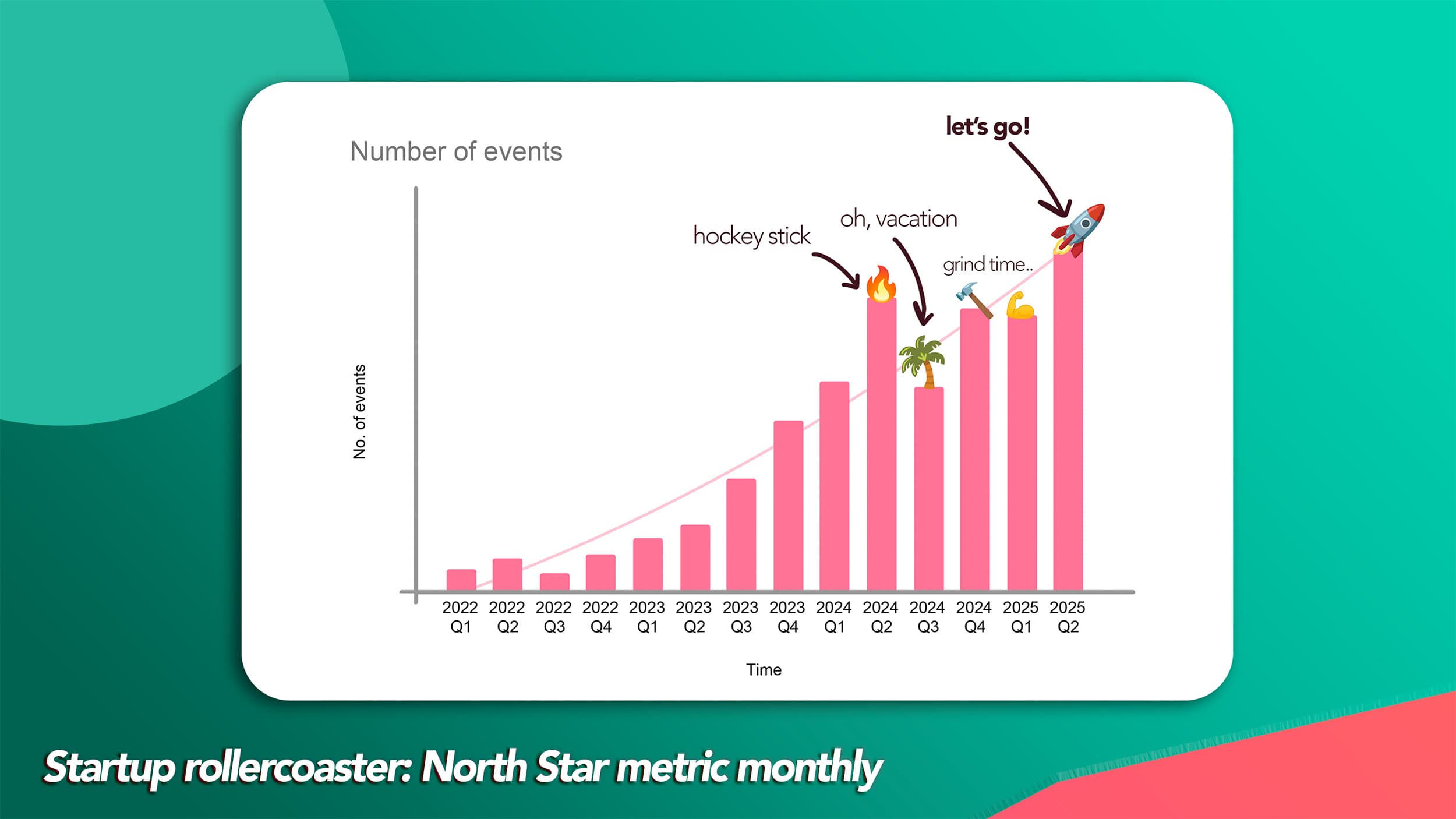

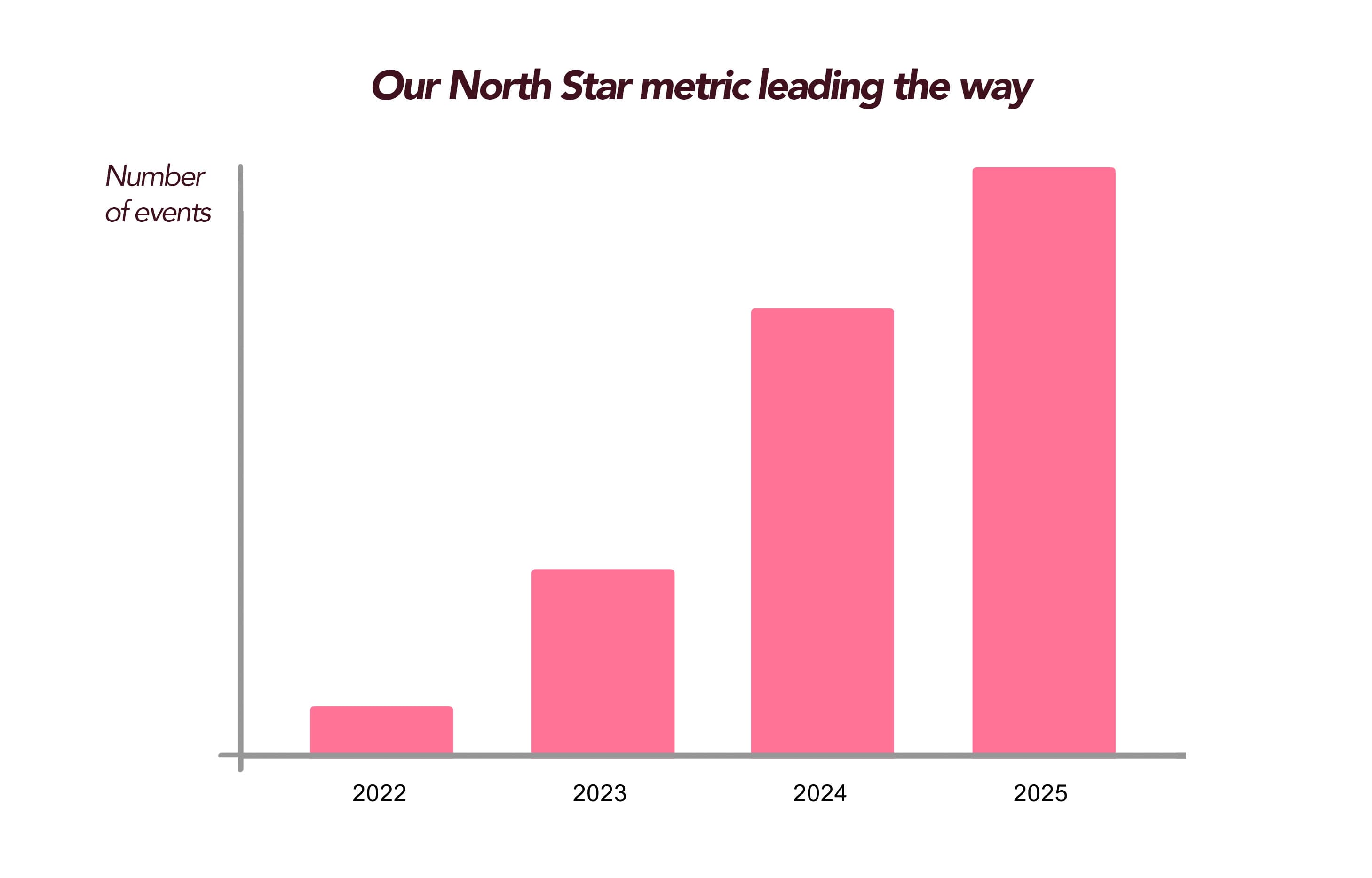

1. North Star metric

Our North Star metric is the number of events hosted on our platform per month. For you, this is probably something completely different.

What does it say: It shows usage and energy in the platform. Acting as a leading indicator for network effects, where new event attendees turn into new customers themselves.

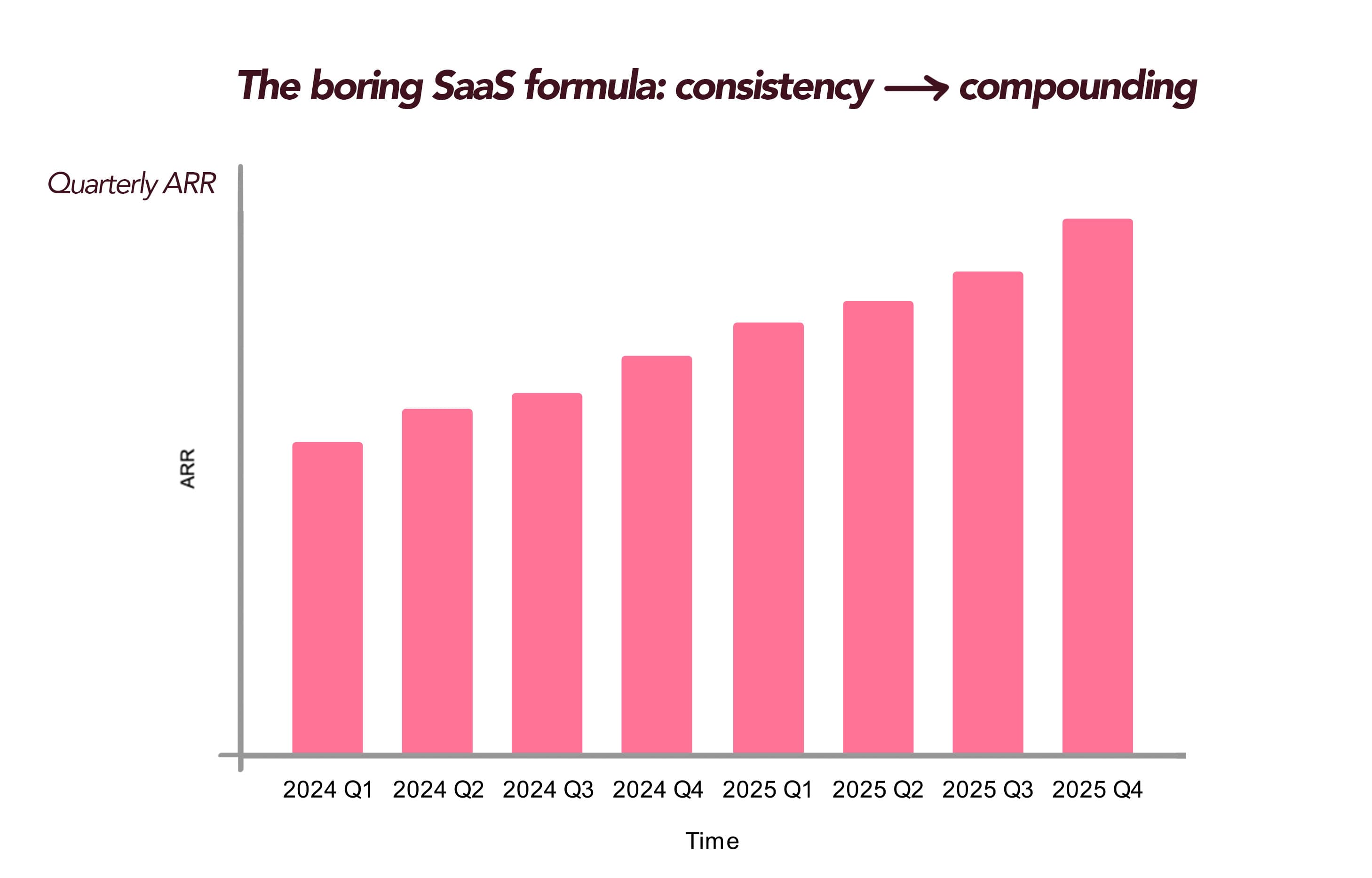

2. ARR - Annual Recurring Revenue

Annual Recurring Revenue is a key indicator of how the business is growing overall. It's a lagging indicator, meaning it follows activity you have already done - like marketing, sales, booked demos, hosted events, or upsells.

Our current target is $2M ARR.

What does it say: Revenue growth and size.

I would recommend looking at 6 months rolling ARR to help understand growth over time. Also, comparing the actual ARR to the planned ARR to get an idea of where you are heading.

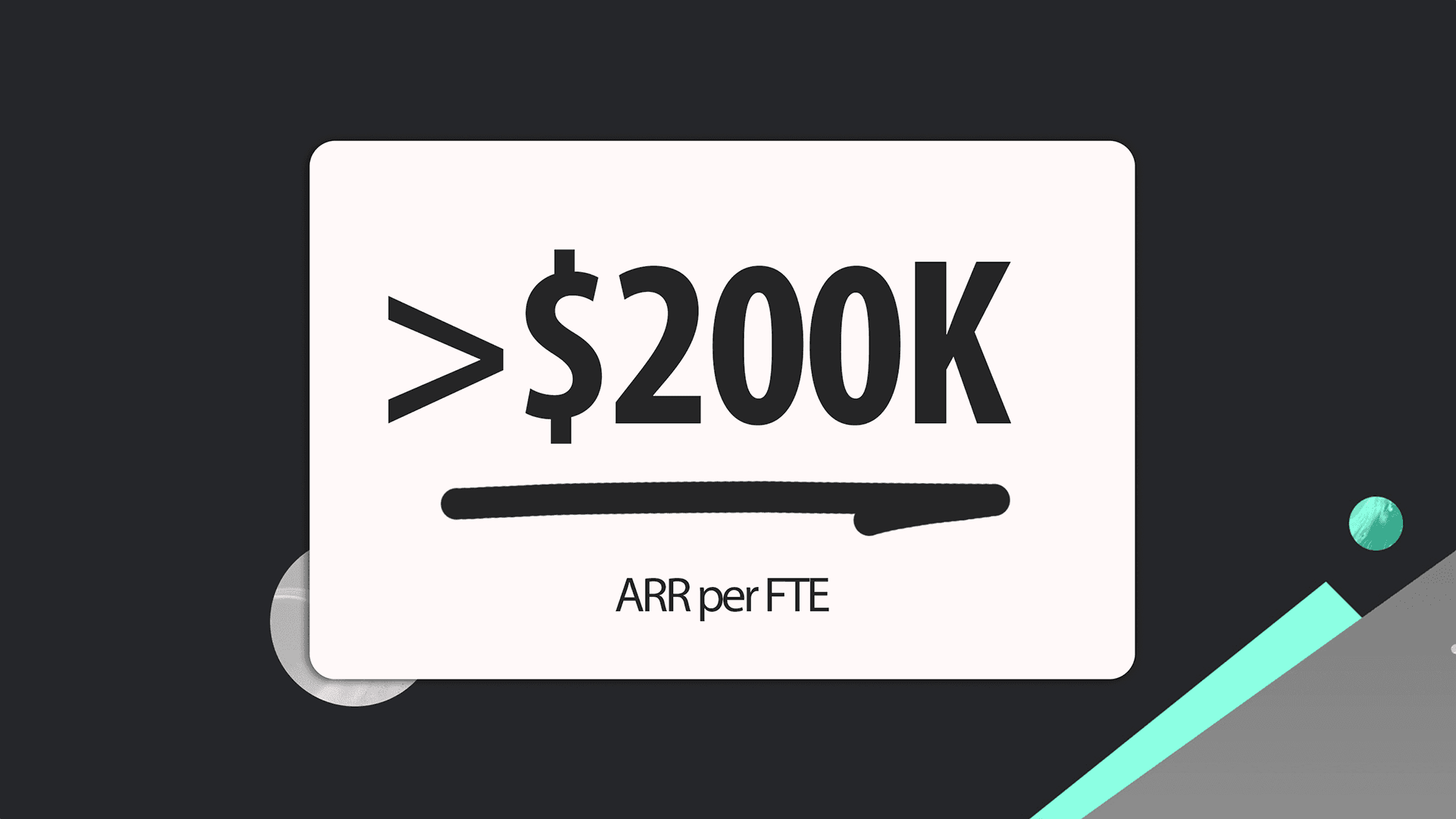

3. ARR / FTE - how efficiently are we operating

If you have bootstrapped and operate on a profitable basis, you are already efficient by nature. But measuring revenue per employee is a good sanity check to know just how efficient you are vs other SaaS.

What does it say: How efficient and automated your SaaS is, which translates to value, as it likely means it's easy for someone else to run as well.

We are running efficiently given our size, with > $200K ARR/FTE.

For more benchmarks, see the full ARR/FTE article.

Other SaaS metrics

There are tons of metrics to track in a SaaS - knowing which ones are important to you, and following those, is the only thing that matters.

Also, as you grow and get more sophisticated, you can break the SaaS metrics down into cohorts - for example, based on customer deal size, markets, or acquisition channels.

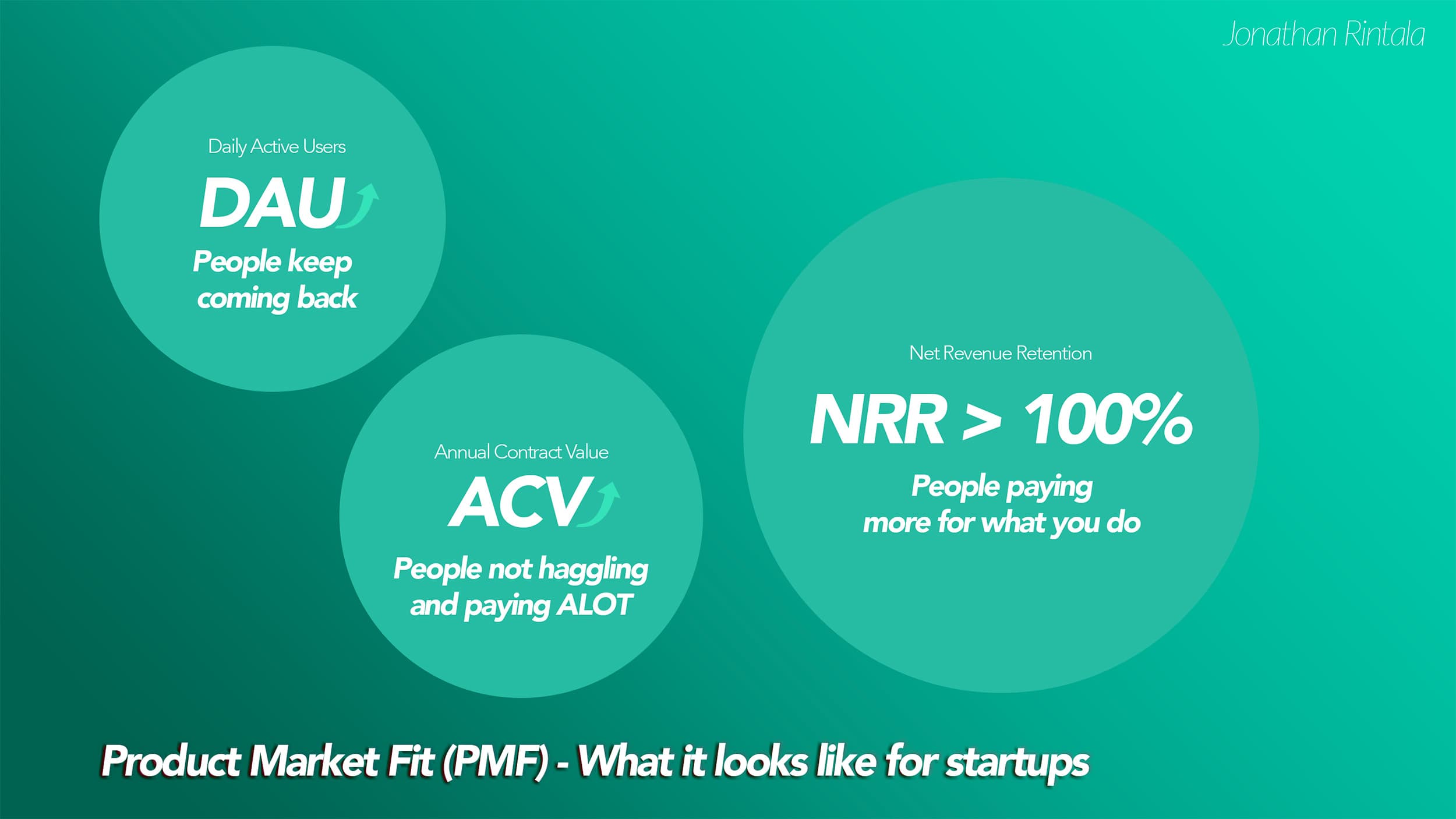

NRR - Net Revenue Retention

MoM growth of ARR

Rolling 6 months ARR growth

Number of demos

ACV - Average Deal Size

Number of new signups

Number of new customers

CAC

CAC vs LTV ratio

What metrics do you keep closest to heart when building your SaaS?

Want to learn more about growing SaaS companies?